Here’s our complete list of countries with retirement visas in 2024. The good news is that there are many options for people planning to retire abroad. Importantly, it is not just immigration options labeled “Retirement Visa” that you can use; there are many other options. Read on for our guide to countries with visas and residency for retirees – and we’ll show you how to qualify and apply.

Countries with Retirement Visas

European Countries with Retirement Visas

- Bulgaria, France, Greece, Ireland, Italy, Portugal, Spain

Central America Retirement Visa Countries

- Belize, Costa Rica, Mexico, Nicaragua, Panama

South American Retirement Visa Countries

- Argentina, Brazil, Chile, Colombia, Ecuador, Uruguay

Asian Countries with a Retiree Visa

- Indonesia, Malaysia, Thailand, The Philippines

Middle Eastern and Africa Retiree Visa Countries

- Dubai, Mauritius, South Africa

Oceania Countries with a Retirement Visa

- Fiji, New Zealand, Vanuatu

Retirement Visa Income Requirements

Most retirement visas have an income requirement. Be careful, as these requirements can be very specific. We’ve included a link for each country so that you can find out more.

To make the comparison easy, we’ve quoted all income amounts as the monthly minimum in US Dollars ($ USD). Note: these are calculated using exchange rates in Q1 2024 and are subject to change.

.

Note: This is a list of countries that have recognized Retirement Visas. However, other countries may also have visas that retirees can use to immigrate. And the countries above may have different visa and residency options that may be better suited. Check out more options for moving abroad if your top Golden Years destination is not on the list.

You will need more income for any dependents

If you include a spouse or other dependent on your application, expect to show more income. The additional income requirement for dependents ranges from 25% to 100% of the main applicant’s amount.

Income requirements to check for

- ✅ Can the income be from work, or must it be passive?

- ✅ How many years of income do you need to show?

- ✅ Is the income temporary, historical, or guaranteed into the future?

- ✅ What passive income sources are acceptable?

- ✅ Do state pensions, private pensions, annuities, royalties, social security, or investment income qualify?

Other Common Retiree Visa Requirements

Each visa name in the table above has a link to a page with detailed requirements for each visa.

Evidence of Financial Security

Some immigration departments look at your finances in more detail than just showing qualifying income. They may ask you to provide:

- A deposit into a qualifying bank account.

- Proof of saving in your home country or your new home.

- A detailed income and expenses statement. The immigration service may require a sign-off from an accountant.

- A commitment to employ local citizens – in Indonesia, the requirement is for at least two employees (domestic help, nursing staff, driver, gardener, etc.).

Note: Always check the requirements for translation and certification of documents you present. In many cases, you’ll need authorized translators, and there’ll be a list of approved providers. And, there are different types of certification.

Qualifying citizenship

Some programs are only open to citizens of approved countries. You should check with your immigration lawyer to ensure you can apply. In Argentina, there is no written rule excluding some countries. However, our Argentina Immigration Law partner confirms that certain nationals have more challenges than others.

Residency requirement

Programs like the Portugal D7 Passive Income Visa and Spain’s Non-Lucrative Visa have minimum residency requirements. This requirement means there is a minimum time you must live in the country to renew your visa.

Health Insurance

Most governments require some form of insurance cover. The requirement can be for local private health insurance, local public insurance, or Expat Health Insurance.

The Spanish private insurance requirement for visas is very specific. You must use a company registered in Spain, and the policy must be fully comprehensive with no gap payment.

Minimum Age

Some programs have a minimum eligible age ranging from 35 to 65 years old. Others don’t have a minimum, and anyone can apply.

Health Check / Health Certificate

The immigration service may ask for a current certificate of health from a doctor. The requirements and process vary by country.

Police Clearance / Police Certificate

Most programs will want to know that you are “of good character”. Generally, this means showing police records with no major criminal convictions from any country you have lived in. The time varies from 2 to 5 years.

Important Aspects to Consider

How long is your retirement visa valid?

Programs range in duration from one year to five years.

Can you renew?

What is the renewal process, how long does it take, and how do you qualify?

Can you apply for permanent residence and citizenship?

Many retirees move to their new homes with long-term plans. In many cases applying for permanent residency makes sense. As a permanent resident, you no longer have to renew your immigration permission or meet the visa requirements. Citizenship may be the next logical step.

Can you work?

Many retiree visas restrict working. Some forbid all work, while others allow remote work or freelance work.

What is the tax implication of retiring to a new country?

In many countries, the government won’t tax your foreign income at all. However, some countries may have higher tax rates than you are used to. Some countries have additional taxes for Expats, like Spain’s Wealth tax.

Getting your social security or pension income tax-free makes a low cost-of-living country even cheaper.

Speaking to a good local tax expert is essential to ensure there are no ugly surprises!

Are there any extras in the program?

Panama’s Pensinado program has great discounts and freebies. Malaysia’s MM2H program also has some extras for those who qualify.

Other Income Visas You Can Use to Retire Abroad

We have discussed a range of countries’ retirement visas above. But, just because your dream destination does not offer a visa explicitly aimed at people who want to retire overseas, don’t give up. Many other visas and residence options can work for retirement instead of a dedicated retirement visa.

Check out our article on Passive Income Visas for more details on some of these programs. There is a range of opportunities as long as you can show that you have a steady income that will cover your living expenses. They generally don’t have any age restrictions.

These visas can also lead to residency, permanent residency, citizenship, and a passport.

Explore immigration programs with names like:

- Passive Income Visa

- Income Visa

- Person of Independent Means Visa

- Non-Lucrative Visa

- Elective Residency Visa

- Rentista Visa

These options cover many countries for you to consider as your overseas retirement destination.

Investment / Golden Visas to Retire Abroad

Using a Golden Visa as your retirement visa can be a great option. Retirees looking to buy property, start a business, or invest in the local economy may qualify.

Check out our list of investment visa options to see if your favorite country is on the list.

The Easy Way to Get a Retirement Visa

Our network of trusted immigration lawyers makes the process as painless as possible.

We only work with immigration law firms that:

- Are experts in their field.

- Deliver outstanding service and value.

- Offer a no-obligation initial consultation to see if they can help you.

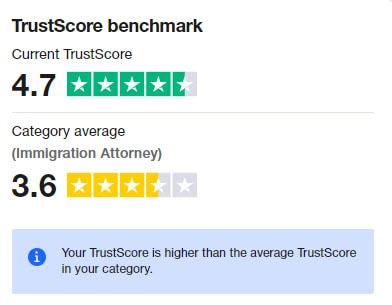

That’s why Where Can I Live has a TrustPilot ranking more than 30% above the average immigration attorney.

Book a consultation with a Where Can I Live trusted Immigration lawyer today.

Which Retirement Visa Country Will You Choose?

Millions of people are choosing to retire overseas. According to the Social Security Administration, US overseas retirement grew by 40% from 2007 to 2017.

What is behind the change? There are many reasons, including cheap airfares for family visits and tools like Skype, Zoom, and Facebook to stay connected. Retiring abroad can offer affordable healthcare, a low cost of living, and vibrant and engaged communities worldwide. These factors mean this trend is only going to increase. So, which countries with retirement visas are on your shortlist?

Which country has the easiest retirement visa?

For simplicity and favorable conditions for retirees, Portugal and Panama often rank as having some of the easiest retirement visas. Portugal’s D7 Passive Income Visa requires proof of stable income of around $700 per month, making it accessible. Panama’s Pensionado Visa demands a monthly pension of $1,000, offering numerous retiree benefits and a straightforward application process. Spain is also attractive for its Non-Lucrative Visa, needing proof of sufficient funds (around $2,400 per month for the main applicant) and offering a high quality of life, though it has a slightly higher income requirement than Portugal.

Do you need a visa to retire in another country?

Yes, if you plan to retire in another country and live there long-term, you will generally need a visa or residency permit that allows for a prolonged or permanent stay. While the specific type of visa or permit may vary — some countries label it explicitly as a “Retirement Visa,” while others may offer a different type of visa that can also be used for retirement — the purpose is to provide legal residency status to retirees who meet certain criteria.

It’s crucial to research each country’s requirements thoroughly, as they can vary significantly in terms of income requirements, health insurance, and other factors. Consulting with immigration experts or legal advisors in your country of interest is also highly recommended to navigate the application process smoothly and ensure compliance with all legal requirements.

Where can you get a retirement visa?

As outlined in the article, numerous countries offer retirement visas or equivalent residency options, including but not limited to:

– European Countries: Bulgaria, France, Greece, Ireland, Italy, Portugal, Spain

– Central America: Belize, Costa Rica, Mexico, Nicaragua, Panama

– South America: Argentina, Brazil, Chile, Colombia, Ecuador, Uruguay

– Asia: Indonesia, Malaysia, Thailand, The Philippines

– Middle East and Africa: Dubai, Mauritius, South Africa

– Oceania: Fiji, New Zealand, Vanuatu

Each of these countries has specific programs designed to attract retirees by offering them residency based on various criteria, primarily centered around financial stability and health insurance coverage.

What are the most common criteria for a successful retirement visa application?

Proof of Steady Income: Applicants must demonstrate a stable income, often from pensions, retirement accounts, or other passive sources. The required amount varies by country but is intended to ensure that the retiree can live comfortably without working.

Health Insurance: Applicants are usually required to have comprehensive health insurance that is valid in the host country. Some countries specify that the insurance must cover all medical expenses without significant deductibles.

Clean Criminal Record: A clean police record is essential, with many countries requiring police clearance certificates to prove that the applicant has no major criminal convictions.

Minimum Age Requirement: While not universal, some countries have a minimum age requirement for retirement visa applicants, often set between 50 to 65 years old.

Residency Requirements: Some countries may require the retiree to spend a certain amount of time within the country to maintain their visa status. This varies significantly across different nations.

Proof of Accommodation: Applicants may need to show that they have a place to live, whether through ownership, rental, or a lodging arrangement.

Financial Solvency: Beyond income, some countries examine the overall financial solvency of applicants, including savings and investments, to ensure they can support themselves long-term.

Health Check: A medical examination or health certificate may be required to prove the applicant does not have any serious health conditions that would burden the host country’s healthcare system.

This insightful article on retirement visas provides a comprehensive overview of 28 enticing options for retirees worldwide. The diverse range of countries mentioned caters to various preferences, offering not only a peaceful retirement but also unique cultural experiences. From the tranquil landscapes of New Zealand to the vibrant cultures of Thailand and Portugal, the article highlights the accessibility of retirement-friendly policies. The well-researched information serves as a valuable resource for those contemplating an international retirement. It’s a compelling read that inspires wanderlust and prompts readers to consider exciting alternatives for their golden years.