The best way to send money internationally depends on several key factors. What’s important to you when you make overseas transfers? The right choice depends on whether you want speed, security, value, or a mix of all three.

Today, you have more choices for international money transfers than ever before! We’ll look at all your options and give real-world examples of how to send money internationally in 2024.

In the last few months, I’ve personally:

- Moved savings from Australia to Spain.

- Paid suppliers in 15 different countries in 6 currencies.

- Sent money to overseas family members and received money from others.

- Withdrawn foreign exchange for overseas holidays.

All of those transactions were cheaper and faster than they would have been five years ago – some were even free! Keep reading to find out how you can do the same.

The Best Way to Send Money Internationally

There are seven popular ways to transfer money overseas. To make your choice easier, we’ll look at when each might be the best option for you.

- Bank-to-bank. You instruct your local bank to make an international transfer to the recipient’s bank account.

- International transfer service. You pay your local currency directly to the transfer service in your home country and currency. The money transfer company then deposits an agreed amount into the local account of the recipient.

- Digital banking services. Neo-banks and online-only banks are moving into this space. Some new players, like N26 and Revolut, offer low-cost international FX and free international withdrawals to their customers.

- International wire transfers. These remittance series transfer money to an account, a mobile, or an office for cash collection.

- Multi-currency debit cards. These Visa or Mastercard services allow you to load a card with your home currency via a bank transfer. You then simply withdraw forex from an international ATM.

- Use an international platform to do the exchange for you. Buying something from a foreign Amazon vendor or hiring an international freelancer through Upwork has a built-in forex transaction.

- Cryptocurrency transfers. You can transfer or convert crypto into fiat currency (local currencies like the US dollar or Euro) across national borders and banking systems.

The Fastest Way to Transfer Money Abroad

If time is of the essence, there are ways to make funds available immediately or at least on the same day. Not all countries accept same-day service, and you may have to pay extra for the rush. Also, the way you pay can either speed up or slow down the transfer.

In general, if you show up with a stack of cash, it will be immediately accessible to your recipient. Credit card or debit (ACH) payments will also show up faster. Payments from a checking or savings account usually take longer because the account information must be verified first.

Here are the fastest ways to send money abroad in 2024:

WorldRemit: Besides having some of the fastest delivery times, it’s also quick and easy to create an account. Cash transfers are available instantly for the recipient; they just need to sign or show their mobile phone. WorldRemit often has lower fees for cash exchanges than its competitors.

Xoom: Xoom aims to be the fastest way to send money abroad. Xoom works through PayPal and has options for cash pickup, bank deposits, and delivery directly to an address. Most remittances are available immediately for the recipient when they sign up.

MoneyGram: MoneyGram is one of the largest remittance services globally. They’ve recently launched FastSend, which lets you send money directly via text message. They can frequently offer same-day delivery regardless of payment choice for the money you have sent.

Western Union: Western Union covers many countries that other services don’t. Their fees and limits vary by country. The company has an extensive global network giving it an advantage for “cash in person” and “cash-pickup” delivery options.

In general, you pay for speed, and this is no exception. These services will often have higher fees or lower exchange rates than slower services.

The Cheapest Way to Send Money Internationally

If you plan on making multiple transfers, you’ll want an established service with low fees. Learn more about the best way to send money internationally to avoid high charges.

BE AWARE: providers charge fees in many ways. Low fees may be offset by a poor exchange rate or vice versa. Don’t fall for a great headline with expensive hidden costs.

Many providers have a transparent fee model. On their website, you can see the exact amount that will arrive in the overseas account. This information gives you a clear understanding of the additional fees involved.

Our top three options for cheap international money transfers

Wise (formerly TransferWise): Wise charges only mid-market exchange rates with no markup and has low upfront fees (typically less than 1%). These rates are exceptional value for most transfers, even at low amounts.

OFX: OFX never charges transfer fees, and their exchange rates can be competitive for large amounts (more than $25,000). This works in your favor if you need to send a lot of money since other companies may increase their fees for large money transfers. The downside is they’re not the fastest, so if you need same-day service, you’ll need to look elsewhere.

Cryptocurrency: If your recipient is happy to be paid in crypto, there could be only a small crypto transaction fee. Even if you want to do a fiat/crypto/fiat transfer, the charges could still be very low. The amount you lose will depend on your crypto coin and exchange choice. So, if both sender and receiver are savvy in the crypto world, you could save a lot if you transfer money frequently. Please see our cryptocurrency section below. Some crypto trading platforms, including Coinbase, don’t charge transfer fees for transfers within their platform.

Remember: the cheapest option may not be the best way to send money internationally. You may have to trade speed or convenience for cost.

The Safest Way to Transfer Money Overseas

Most big-name finance services have a high degree of security and dependability, but if you’re concerned about safety issues, these are your best choices:

Wise: Wise has earned a reputation for fast, dependable, and secure transactions. Since it has to comply with UK regulations, Wise is a good choice for the safest way to send money internationally. As one of the largest money transfer companies globally, you can consider your money safe.

WorldRemit: WorldRemit is based out of London and must adhere to strict UK regulations. They follow the Financial Conduct Authority (FCA) standard, making this already very safe remittance service even more secure. They also have an app for sending money directly to a mobile phone. Your bank: Generally, your bank will be a security-focused organization. Banking regulations and guarantees ensure that your money and transactions are protected in most countries. Traditionally, banks were a secure way to send money abroad. Nowadays, there’s a lot of competition that can usually beat banks in fees, ease, and speed. Each international money transfer through your bank can incur huge fees, and exchange rate spreads can be terrible.

The Best Apps to Send Money Internationally

There is also a new breed of money transfer service direct from your smartphone. These apps are often easy to set up, have decent support, and operate at any hour of the day. You should always compare the actual payout amount before you commit to one service.

OFX: OFX is one of the best remittance apps out there. They have the broadest reach and offer service to people worldwide, serving 195 countries. One thing to be aware of is that you can’t pay with a credit card, and there’s no option for a cash pickup location. This makes it better for sending larger amounts of money from a checking or savings account.

Remitly: Remitly is good for low fees and lower money transfer amounts. Their well-designed and user-friendly app has 5-star reviews from happy customers. Plus, it tells you the exact date and time your money will arrive, backed by a money-back guarantee. This app is excellent for delivering money to Asia, South America, or Africa. Their app means you can send funds to a mobile phone.

PayPal/Xoom: Not the cheapest option, but they’ve got it dialed for ease of use and user experience. You can use a PayPal balance or link to a bank account. The catch is that you and your recipient both must sign up for PayPal accounts. This process isn’t complex but will take a little time.

WCIL Choice: The Best Way to Send Money Internationally In 2024.

With all the ways to send money abroad, it can feel overwhelming trying to pick the right one. Consider location, time of day, and payment method to find the best money transfer service for your payment.

But, all things being equal, here are our best ways to send money internationally in 2024.

Number 1 >> Wise (formerly TransferWise)

Wise frequently gets top marks due to its transparency, commitment to low cost, excellent website, and excellent customer reviews. You can pay with a linked bank account, debit or credit card, Apple Pay, or Google Pay. They also have flexible daily set maximums. Their borderless online bank account is also worth a look. In general, if you show up with a stack of cash, it will be immediately accessible to your recipient. Any credit card or debit (ACH) payments will also appear faster. If speed matters, this service is worth investigating. Just be aware, some payments from a checking or savings account can take longer as the account information must be verified.

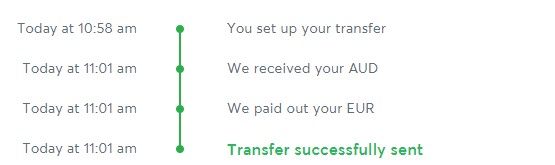

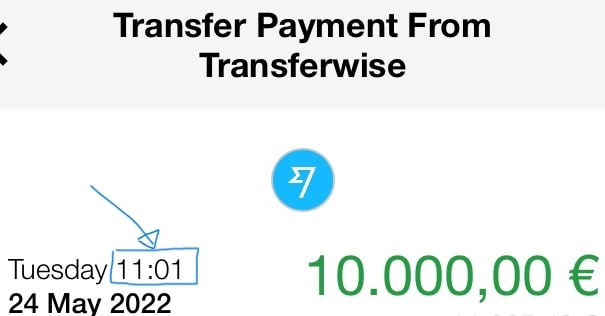

I completed a transfer in May 2024 from Australia to Spain. Not only was the cost minimal (AUD68 on a €10,000 transfer), the money was available in my Spanish bank account just 4 minutes after I logged onto my Wise account to set up the transfer. See these screenshots with the timestamps.

Number 2 >> WorldRemit

WorldRemit: WorldRemit allows money transfers in 90 different currencies to over 150 countries. It’s safe, fast, and frequently offers the lowest fees for cash transfers, though it’s best for lower dollar amounts. You can pay with a linked bank account, debit or credit card, SOFORT, INTERAC, POLI, or iDEAL. It’s also a great way to transfer money internationally if you send funds to Nigeria or Mexico from the UK or US.

Number 3 >> Xoom

Xoom: Xoom is fast, even for transfers done with a bank account, and it offers service to over 160 countries. It also allows you to send from $10 to $50,000 per day. You can pay with a linked bank account, debit, or credit card. You can also use your PayPal balance, though their credit card fees tend to be high. To send larger amounts, you’ll have to register for an advanced account that requires your personal information to be verified.

Risks include rapidly fluctuating cryptocurrency values, a lack of regulation, and the risk of user error costing you. We suggest you learn how to manage these risks before using this money transfer method.

With N26, you can get a fully functional current account, business account, overdraft capability, and investment options. It also has a Debit MasterCard, and in some countries, you can also get a Maestro Card. You’ll get a European BIC and IBAN.

N26 operates in Germany, Austria, Switzerland, Ireland, France, Spain, Italy, the Netherlands, Belgium, Portugal, Finland, Luxembourg, Slovenia, Estonia, Greece, Slovakia, Poland, Sweden, Denmark, Norway, Liechtenstein, Iceland, and the United States. The UK is excluded since BREXIT.

N26 holds a full German banking license with a €100,000 deposit guarantee.

Using Cryptocurrencies to Transfer Money Internationally

In the past several years, there’s been a rise in cryptocurrencies (digital currencies) for sending and receiving money internationally.

Overhead Costs

Using digital currencies like Bitcoin, XRP, Litecoin, or Ethereum can increase speed and decrease fees because the whole process is cloud-hosted. This cuts out many overhead costs that traditional services incur.

Upper and Lower Limits

There are no upper or lower limits on the amount you can send because the whole point of cryptocurrencies is to be beyond borders. Some experts claim cryptocurrencies are the best way to send money internationally due to these facts.

You’ll still need to exchange your cryptocurrency twice – once by the sender and again by the receiver. You first have to buy the cryptocurrency; then your recipient has to convert it into their local currency. Suppliers like Coinbase don’t charge any fees for transfers between clients on their platform.

Exchange Rates

Traditional services can guarantee an exchange rate, but this isn’t possible with cryptocurrencies. That said, both sender and receiver typically don’t hold the digital currency for long in a regular exchange. This means that you’re unlikely to see a drastic fluctuation in the rate.

Learning Curve

There’s a steep learning curve if you’ve never used cryptocurrencies before. Start your research on the current exchange rates, then compare them to traditional transfer services before using cryptocurrency to send money abroad.

Risks

Risks include rapidly fluctuating cryptocurrency values, a lack of regulation, and the risk of user error costing you. We suggest you learn how to manage these risks before using this money transfer method.

Neobanks, Online Banks, Challenger Banks, and Digital Banks

The definition of a bank is changing as financial services undergo a serious disruption. A “bank” with no branch might be the complete package to get the best service. If you are moving abroad, it is worth exploring these options before checking local banks in your new home.

Freelancers, digital nomads, remote workers, and more can benefit from these services. And anyone who regularly travels should explore the option as well.

Here are two established and highly rated online banks.

N26 – licensed in Germany

With N26, you can get a fully functional current account, business account, overdraft capability, and investment options. It also has a Debit MasterCard, and in some countries, you can also get a Maestro Card. You’ll get a European BIC and IBAN.

N26 operates in Germany, Austria, Switzerland, Ireland, France, Spain, Italy, the Netherlands, Belgium, Portugal, Finland, Luxembourg, Slovenia, Estonia, Greece, Slovakia, Poland, Sweden, Denmark, Norway, Liechtenstein, Iceland, and the United States. The UK is excluded since BREXIT.

N26 holds a full German banking license with a €100,000 deposit guarantee.

The card offers free international withdrawals (or 1.7% on some accounts), foreign transactions, and instant transfers. International transfers are free and use the Wise network (often fee-free). N26 also offers benefits like international travel insurance free with premium accounts.

Revolut – licensed as a bank in Lithuania

Revolut offers a very similar service to N26 and operates in more countries. These countries include Australia, New Zealand, the USA, and the UK.

The Revolut card does open up a range of financial services. You can buy gold, crypto (five major coins), and foreign exchange easily and quickly.

You can transfer money abroad using more than thirty currencies with the interbank exchange rate. They charge a 0.5% fee for anything above €1,000 each month. And, the rates go up for some currencies and on weekends.

You are charged standard interbank rates on 150 global currencies with no hidden extra fees when you spend money abroad.

Choosing the Best Money Transfer Service for You

With countless money transfer services to choose from, picking the right one can be a challenge. Let’s examine the pros and cons of each service and how to get started.

Wise

Pros

Borderless Bank Account. Wise gives you the ability to hold balances in over 50 currencies, enabling overseas transfers and international payments across borders.

Simple Sign-Up Process. Making an account on Wise is completely free and super simple. All you need is an email address or a Google, Apple, or Facebook ID. You are not required to pay a subscription fee or maintain a minimum balance. Bank account details are only needed before making a transfer.

User-Friendly Dashboard and App. Wise has a smart user-friendly dashboard that’s highly intuitive and easy to use. The app also garners decent ratings and reviews on the Play Store.

Affordable Money Transfer Fees. Wise is one of the cheapest ways to send money internationally due to its extremely low fees. The charges are calculated based on factors such as transfer amount, currency, and exchange rates. Wise makes use of mid-market rates from Reuters and allows you to lock in a rate within a set timeframe. This ensures that you don’t lose extra money due to exchange rate fluctuations.

Transparent Cost Estimate. Before you transfer funds with Wise, you can calculate the money transfer fees through a simple calculator on their website. Enter the amount of money you want to transfer and choose your currency, Wise will give you a complete breakdown of all the costs.

Wise Is a Safe and Trusted Company. After over a decade of service, Wise has established itself as a trustworthy money transfer service. With an “Excellent” rating and stellar reviews on TrustPilot, Wise is one of the most reliable and trusted services out there.

Cons

There’s a Maximum Transfer Limit. Wise limits the maximum transferable amount to $1,000,000 or its equivalent in your currency. While this is an ample amount for small businesses and independent freelancers, it’s not feasible for companies that require large money transfers.

Unexpected Account Deactivations. There are complaints that Wise sometimes deactivates users’ accounts or cancels transactions. However, Wise maintains that these actions are taken as a result of security concerns and policy conflicts.

Transfers Take Longer Than Expected Sometimes. Users have complained about the occasional high latency of money transfers. These delays are probably caused because Wise relies on local exchanges for money transfers. While this helps lower the costs, it can be time-consuming. So, if you value timely transactions over lower money transfer fees, you might want to look elsewhere.

How to Transfer Funds through Wise

Step 1: Log into your Wise account and choose “Send Money.”

Step 2: Add in your amount and select your currency.

Step 3: Browse your Wise address book to select the recipient.

Step 4: You might need to upload an ID to verify your identity before your transfer can be confirmed.

Step 5: Double-check the summary of your transaction including the money transfer fees and exchange rate. Once you’re satisfied, select your preferred payment method and finalize the transfer.

OFX

Pros

Free and Straightforward Sign-Up Process. Signing up for OFX is completely free of charge and super easy. The streamlined sign-up process can be completed within three steps.

- Choose the type of account you want to open. Options include personal or business.

- Fill in some basic personal details like your name, address, and contact number.

- Verify your identity by attending a phone call from OFX.

Safe, Regulated, and Reliable. OFX is a well-established, publicly listed, and regulated company with customers from all over the world. The service provides insurance against bankruptcy so you can get your money back in case of extreme circumstances. The website is secured through encryption and identity verifications. You can also set up 2 Factor Authentication to add another level of security.

Low Money Transfer Fees. OFX doesn’t charge a registration or monthly subscription fee. It only takes a small percentage of your transfers.

No Maximum Transfer Limit. Apart from having an extremely low minimum transfer amount of A$250, OFX doesn’t have a maximum transfer limit.

Gives a Variety of Bank Funding Options. With OFX you have the option to fund your transactions through electronic funds transfer, domestic funds transfer, BPAY (if you live in Australia), and direct debit.

Cons

Phone Call Verification is Required for Sign Up. The signup process may be simple but OFX requires an on-call verification to open an account. This might be an inconvenient obstacle as there are easier and more efficient ways of identity verification.

You Can Only Fund Transfers Via Bank Account. OFX only allows funding transfers through your bank account. Meanwhile, the recipients can only receive money in their bank accounts. Other money transfer services offer multiple options such as cash, check and debit cards.

No Cost Estimates Before Sign Up. In order to see the transfer rate you’ll be paying, you have to sign up for an account on OFX. There’s no calculator or estimation service to help you make the decision beforehand. There’s also a minimum transfer amount of A$250 which might be restrictive for some.

Lost or Delayed Transfers. Some OFX users complain about delayed or lost transfers. The service promises transfers within 3 to 5 business days. This can be quite a long time for people who are accustomed to faster money transfer services.

How to Transfer Funds through OFX

Step 1: Log into your OFX account and select the Recipients tab.

Step 2: Simply add the recipient’s bank details to create a new profile.

Step 3: Now click the “New Transfer” tab and select your amount and currency. Check the exchange rate calculated by OFX and click continue if you’re satisfied with it.

Step 4: Choose a recipient from your list. Double-check all the details before clicking “Confirm.”

Step 5: Check your email account for a confirmation email from OFX. This will contain the details of your transfer including various payment options.

Cryptocurrency transfers

Pros

Quick and Straightforward. Cryptocurrency transactions are fast and straightforward. You can transfer cryptocurrency through smartphones and computers without the hassle.

Built on Secure Blockchain Technology. A public list called a blockchain keeps records of each cryptocurrency transaction that occurs. The history of such transfers can easily be traced to avoid any unsavory activities.

Reduces Overhead Costs. Blockchain technology is based on building a decentralized system that skips intermediaries like banks, cutting back on overhead costs. All you’ll need to pay is a small transaction fee even in the case of crypto to fiat and vice versa. Additionally, if you and the receiver are well-versed in crypto, you can save up a lot on transfer charges.

No Upper or Lower Transfer Limits. Cryptocurrencies do not have an upper or lower transaction limit. This means it’s good for both small businesses and large companies alike.

Cons

Rapidly Fluctuating Cryptocurrency Values. Cryptocurrency values tend to fluctuate drastically. The unpredictable nature of crypto makes it quite risky to convert into real money.

Vulnerable to Scammers and Cyber Attacks. Since all crypto transactions are cloud-based, they are highly vulnerable to cyberattacks.

Lack of Regulation. It is a largely unregulated and unpredictable market. User error can also cost you a lot of money.

Steep Learning Curve. If you’re new to crypto, you may need a lot of research before you can safely make overseas transfers.

How to Transfer Funds through Cryptocurrency

The process of transferring money through crypto may vary depending on the wallet you’re using. However, the basic procedure looks something like this:

Step 1: The first step is to set up a crypto wallet. There are many choices including mobile wallets, exchange wallets, or desktop wallets. Once you have a crypto wallet, select the Send option to start the transferring process.

Step 2: Depending on the wallet you chose, you may be prompted to select a cryptocurrency next. In some wallets, you may have to choose your cryptocurrency before you select send.

Step 3: To transfer funds, you need a public key to your recipient’s wallet. This can come in the form of a QR code or an alphanumeric address. Either scan the QR code or copy-paste the address to add your recipient.

Step 4: Enter the amount you want to send and check if the amount is in fiat or cryptocurrency. If the scanned QR code has a requested amount, it will show up at this point.

Step 5: Don’t forget to double-check all the important details including the recipient’s address, the amount, and currency. Crypto transactions are irreversible so you need to ensure you’re not making any mistakes.

Step 6: Click send and your crypto transaction will be complete!

For beginners, it’s important to make some test transactions before transferring a large amount. You should also make sure you select the right cryptocurrency. For example, you shouldn’t be sending Bitcoin to an Ethereum address and vice versa.

Bank transfers

Pros

Easily Accessible All over the World. Even if you don’t have certain money transfer services in your region, you probably have a bank that enables wire transfers.

Secure Money Transfer. Banks have stringent security procedures and regulations to ensure that your money remains safe and secure. Bank transfers are one of the safest ways to transfer funds internationally.

Cons

High Overhead Costs. It’s usually a more expensive option due to the bank charges. In some cases, even the recipient ends up paying a small amount for the transfer.

Low Exchange Rates. Often provides low exchange rates for transactions. As compared to online money transfer services which constantly update mid-market rates.

Lack of Transparency. There’s a lack of transparency in bank transfers as banks rarely disclose the additional charges and hidden fees that are attached to transactions.

How to Transfer Funds through Bank Transfer

The process of transferring money will entirely depend on which bank you are using. Here are some general steps for online wire transfer:

Step 1: Open up a bank account. If you have one already, simply log in to the online banking service on your desktop or phone.

Step 2: Add the recipient as a beneficiary using their bank account or IBAN.

Step 3: Add in the amount and verify the transaction following your bank’s verification procedures.

Step 4: You and your recipient will probably receive a message from the bank when the transaction is processed.

Western Union

Pros

Extensive Coverage. It’s functional in over 200+ countries, often covering regions where popular money transfer services may not be available.

Multiple Ways to Send Money. Western Union offers a multi-channel network that gives you the option to send money through the website, agent, or phone.

Personalized Business Solutions. WU has various business solutions tailored to your unique situation. These include Fast Hire, Fast Pick, Netspend Prepaid Mastercard, and Easy Pay.

Round the Clock Customer Service. It offers 24/7 customer service through the website, live chat, and email.

Trustworthy and Reliable Service. Western Union has been serving the industry for almost 170 years and continues to handle over 1.7 million transactions per day.

Cons

More Expensive than Other Options. WU is comparatively more expensive than other remittance channels available today. The cash pickups have extremely low exchange rates as compared to other options.

Limited Channels. Western Union may have multiple channels but not all of them are accessible all over the world. For example, if you live in Kenya, you can only transfer money from WU through agents.

Lack of Transparency. There’s little transparency when it comes to hidden fees and margins for exchange rates.

How to Transfer Funds through Western Union

Sending Money for Cash Pickup:

- Sign up or log in to your Western Union account.

- Choose the country and enter the amount. Select cash as the delivery method.

- Enter the recipient’s name.

- Make the payment with your card.

- Once you’re done, you will receive a confirmation message with a tracking (MTCN) number in your email. Share this MTCN number with the recipient so they can pick up the cash.

Sending Money through an Agent

- To send money through an agent, you must be present at an agent’s location in person.

- Provide your original government ID such as CNIC or passport.

- Give your full name and occupation.

- You must also provide the receiver’s full name, relationship to you, address, and bank account details.

- You may be asked for the purpose of the transaction and additional details.

- The agent will provide you with a receipt with a stamp and signature.

- Inform the recipient that the transfer can be picked up.

| Transfer method | Pros | Cons |

| Wise | Borderless bank account. Simple sign-up process, User-friendly dashboard and appLow money transfer fee. Transparent cost estimateSafe and trusted worldwide. | There’s a maximum transfer limit. Unexpected account deactivations. Transfers take longer than expected sometimes. |

| Ofx | Free and straightforward sign-up. Safe, regulated, and reliable. Low money transfer fees. No maximum transfer limit Gives a variety of bank funding options. | Phone call verification is required for sign up you can only fund transfers via a bank account. No cost estimates before signing up. Lost or delayed transfers. |

| Bank transfer | Easily accessible all over the world. Secure money transfer. | High overhead costs. Low exchange rates. Lack of transparency. |

| Western union | Extensive coverage. Multiple ways to send money. Personalized business solutions. Round-the-clock customer service. Trustworthy and reliable service. | More expensive than other options. Limited channels. Lack of transparency. |

| Cryptocurrency | Quick and straightforward Built on secure blockchain technology. Reduces overhead costs. No upper or lower transfer limits. | Rapidly fluctuating cryptocurrency values. Vulnerable to cyber attacks. Lack of regulation. Steep learning curve. |

| World remit | Highly rated app and easy to sign up. Wide range of delivery options An extensive network of agents all over the worldNo minimum transfer amount24/7 customer support. The online calculator gives an accurate estimate | Not the cheapest option in the market. Markup costs depend on chosen delivery method. All delivery methods are not available in all regions. Maximum transfer amount of $10,000 |

| Money gram | Well-established and trusted. Covers 200+ countries. Multiple channels to send money online, in-app, or in-person. | Exchange markup is added to fees. The fee varies depending on location, transfer amount, and destination. Not the cheapest solution. All services are not available in all regions. |

| Xoom | Quick and safe international transfers Available in 160 countries. A wide range of transfer and delivery options. The receiver doesn’t need Xoom account. | Higher fees than other services. Money transfer limit applies. Longer processing time for some locations. |

Real-Life Examples: How People Manage International Money Transfers and Spending

These are examples based on people we know and how they manage their global financial affairs.

Phil – UK retiree living in Spain

“Phil” sold his family home and retired to Spain with his wife. They invested the money in the UK into revenue-producing assets.

- UK banking and investment income – UK High Street Bank + UK broker.

- Spain daily banking – Spain High Street bank.

- Moving money from the UK to Spain – Transfers using Wise as needed.

- The best way to send money internationally? Has used Wise, PayPal, and Western Union to send money to friends and family in the UK and USA.

Bruce – Australian property investor, living in Europe

“Bruce” lives in Spain with his wife and two children. He has a Spanish non-lucrative visa based on income from Australian property investments. Bruce loves traveling and scuba diving.

- Australian banking, rental income, and mortgages – Australian High Street Bank.

- Spanish daily banking requirements – N26 Metal Account.

- Travel Insurance + travel spending – N26 Metal Account.

- Moving money from Australia to Spain – Monthly transfer using Wise.

Donna – American Digital Nomad + content writer

“Donna” spends 6 – 8 weeks in a country at a time. She favors digital nomad hotspots in Europe and Asia. She is a freelance content writer through the Upwork platform.

- Daily banking requirements – Revolut Premium Account.

- Travel Insurance + travel spending – Revolut Premium Account.

- Payments are direct from Upwork into her Revolut account.

- Has used MoneyGram to get cash set to Honduras in an emergency.

Jacqueline – South African crypto trader based in Portugal

“Jacqueline” trades Crypto full-time. She has a Portugal Golden Visa from an apartment she purchased in the Algarve in 2019.

- Daily banking requirements – N26 Metal Account.

- Payments and travel spending – Binance Debit Card.

- Her favorite way to send money internationally? Uses direct crypto transfers to move money between family and friends in Portugal and South Africa.

Jürgen – Remote worker employed by a German company, living in Mauritius

“Jürgen” lives in Mauritius on a Premium Travel Visa. He is a full-time remote employee of a German company. His wages are paid in Germany.

- Salary payments and German day-to-day banking – N6 Premium account.

- Mauritius day-to-day banking. Mauritius high street bank.

- Moving money from Germany to Mauritius – N26 international transfer.

Risks When Sending Money Abroad

All the services we’ve recommended provide safe and secure ways to send money abroad. Still, it’s a good idea to know the potential risks before you begin.

Exchange rates

Most services will lock in your exchange rate when you receive a quote. If you can, it’s best and cheapest to wire money in the currency of the receiving bank to avoid extra exchange fees. If you can’t (and often we can’t), be sure you understand all the fees associated with your transfer. Sometimes a company will advertise low transfer fees only to jack up the exchange rate.

Scammers

Be aware: you should never transfer money to someone you don’t know. Anything that is offered free should ring an alarm bell. There are scams from email, text messages, websites, and direct calls. The scammers are getting slicker and slicker every day.

Scam artists want people to wire money overseas because there’s little you can do to retrieve it once the money leaves your account. Please don’t fall for it, and always use a reputable transfer company to send money internationally. If you think you’ve been scammed, contact the police as soon as possible so that they can investigate the matter.

Hidden fees

Make sure you know all the costs upfront. Companies will often quote the mid-market rate (the exchange rate banks use with each other). Then, they add a markup on top of the exchange rate. Additionally, they may charge transfer fees and commission fees. Remember, a single percentage point can significantly impact your payout amount.

If you have time, compare rates from at least three services to see who can get you the best deal. Some use a free introductory transfer and then lump high ongoing fees. Others have a fee-free offer with terrible exchange rates.

TIP: Always use the final payout amount to ensure you compare apples with apples.

Limits

Some services are better with large transfer amounts, and some are better for smaller ones. Know their limits ahead of time, especially if you know you’ll have to make regular transfers. You don’t want to find out at the last minute that they won’t work with amounts under $1,000 or only authorized linked accounts.

Delays

Delays will happen even with the most established companies. These aren’t always the company’s fault, but they should have a policy in place to compensate you should it happen. Ask upfront about this.

How Do International Exchange Rates Work

Foreign exchange rates make up the biggest hidden costs associated with international payments. The exchange rates are typically quoted against the most stable and commonly used currencies. These include the US dollar, euros, Pound Sterling, or Swiss franc.

International exchange rates are often based on the mid-market rate. This is the rate that big banks charge to exchange currencies with one another. When you send money through a remittance service, they’ll use the mid-market rate and often add a commission on top. Many services don’t reveal this extra fee, making it a hidden cost that you end up incurring. Instead of relying on live exchange rates, it’s better to get an estimate from your chosen service provider before you transfer funds.

How to Avoid the Hidden Money Transfer Fees

As we’ve established, banks and money transfer services add a markup or commission to the mid-market rate. Often this added amount is not disclosed to users, making it a hidden fee that can cause inconvenience.

Here are some ways to uncover the hidden fee behind overseas transfers and how to circumvent it:

Compare the Official Mid-Market Exchange Rate

Sometimes money transfer services don’t use the official mid-market rate to calculate the ultimate payout. Such transactions lack transparency as providers fail to account for the hefty currency conversion charges. If you decide to go through with the transfer, you may find yourself being charged more than you originally thought.

To avoid these hidden fees, it’s important to research the official mid-market exchange rate and compare it with the estimated quote given by the service. Ensure that you’re not paying numerous extra transfer charges.

Search for Correspondent Fee

International money transfers primarily take place through a complicated network known as Society for Worldwide Interbank Financial Telecommunications (SWIFT). One of the major drawbacks of the system is that banks don’t always have branches in every country. In order to be accessible in locations where they have no resources, they have to enlist a correspondent bank.

In this case, SWIFT allows the correspondent bank to deduct an arbitrary fee from the transfer amount. This is a highly unpredictable and opaque process that occurs without your permission. To avoid these correspondent fees, it’s better to choose more transparent money transfer services that provide upfront cost breakdowns.

Look for the Recipient Fee

The recipient fee is another uncontrollable variable within international money transfers. Research whether the bank you’re sending to may charge the receiver a fee. To avoid this complication, you can choose online money transfer companies that charge a fair price and provide transparent cost estimates.

What Details Do I Need For An International Bank Transfer?

Transferring money through a bank is one way you can send money abroad, but it’s not always your best option. In general, if you’re wiring money through a bank, you’ll need to have all your recipient’s banking information handy:

- Full name and address of the bank you’re sending the money to.

- The recipient’s full name and address (some banks only accept physical addresses, no PO boxes)

- The name and number of the account, or the IBAN (International Bank Account Number). You can get the account and IBAN from your bank or through your online account.

- The receiving bank’s SWIFT/BIC code. These are unique identification codes for every bank in the world. You can find these on your statement, or call your bank and ask.

- A reason. Yep, you may need to provide a short explanation of why you need to send money abroad. A simple statement like “work expenses” will do. This is a protective measure for banks to guard against money laundering.

What Are The Main Reasons To Send Money Abroad?

Globalization, cheap travel, and remote work have shrunk the world. And this means there are many reasons you may need money in another country and currency. Here are just a few of those reasons.

- Converting your own money for you to spend while living or traveling abroad.

- Sending money to friends or family in another country.

- A purchase. Anything from a home to a book may require payment in forex.

- Mortgage payments on a second home overseas.

- Investing overseas in a business, property, or other investments.

- Paying for services. It could be international study fees or a destination wedding.

- Getting work done. Paying a freelancer or foreign company.

Interestingly, here are the top 10 currencies for international money transfers from the US

- Mexico (MXN)

- China (CNY)

- India (INR)

- Germany (EUR)

- France (EUR)

- South Korea (KRW)

- United Kingdom (GBP)

- Japan, (JPY)

- Italy (EUR)

- Australia (AUD)

Glossary for Sending Money Abroad

Forex spreads: The spread is the difference between the buy (ask) and sells (bid) commission of the currency exchange. The bigger the spread, the more you lose on a transaction.

Mid-market rate: The exact midpoint between the buy and sell rates.

Spot rates: The exact exchange rate when quoted.

SWIFT/IBAN: Society for Worldwide Interbank Financial Telecommunication and International Bank Account Number. It is a unique ID number for every bank account in the world.

FX: Foreign Exchange abbreviation.

Mid-market rate: The exchange rate that big banks use to transfer money between one another.

Wire transfer: An electronic method of sending funds from one destination to another.

You made it! That is all you need to know to send money abroad successfully!

As you see, there are many ways to send money internationally. Sending money abroad used to be simple, with few choices, but the explosion of options means that the process is now more complex. The upside is you can choose faster, safer, cheaper, and easier ways to live a global life. And, it also means that you have the flexibility to find the best overseas transfer method for you.

FAQs about Transferring Money Internationally

What is the least expensive way to transfer money internationally?

Some of the cheapest ways to transfer money internationally are:

- Wise: Wise charges only mid-market exchange rates with no markup and has low upfront fees (typically less than 1%).

- OFX: OFX never charges transfer fees, and their exchange rates can be competitive for large amounts (more than $25,000).

- Cryptocurrency: If your recipient is happy to be paid in crypto, there could be only a small crypto transaction fee. Even if you want to do a fiat/crypto/fiat transfer, the charges could still be very low. The amount you lose will depend on your crypto coin and exchange choice.

Can I use PayPal to send money internationally?

Yes, PayPal allows you to transfer funds across 200 different countries. Although it isn’t available in many regions. A transaction fee applies depending on which country you’re sending the money to. While it’s not the cheapest option out there, it has an excellent user experience and is simple to use. To send money internationally through PayPal, you and the receiver need to have PayPal accounts.

How Long Does an International Money Transfer Take?

An overseas fund transfer could take anywhere from a couple of hours to multiple days. The processing time depends upon multiple factors including your money transfer service and the recipient’s location. Processing times are naturally longer during the weekend or public holidays.

How do I avoid a wire transfer fee?

Wire transfers can be extremely expensive as some banks may charge incoming and outgoing wire transfer fees. To avoid a wire transfer fee, you can find a service provider which waives this fee or go for a more low-cost online money transfer application.

Is TransferWise a reputable company?

Wise, formerly known as TransferWise, was established in 2011 and currently serves 8 million customers all over the globe. Each month, customers trust Wise with $5 billion worth of transactions. With 100,000 reviews and an “Excellent” rating on TrustPilot, Wise is certainly a highly reputable company. From the FCA to FinCen, they abide by the rules of regulatory agencies in each country. Wise also boasts bank-level data security and an in-house security team.

What is the minimum amount of money you can transfer internationally?

The minimum international transaction amount varies from one money transfer service to another. Depending on which service you choose, it can be anywhere from $0 to thousands of dollars. Find out the minimum transfer limit set by your chosen financial institution.

What do I need to perform an international money transfer payment?

Here are some things you’ll need to perform overseas transfers:

- A bank account or an account on the money transfer service of your choice.

- Sufficient funds to cover the transaction, fees, commissions, and other costs.

- Basic details such as your name, phone number, address, and bank account information. The amount of information you need to disclose depends on your chosen money transfer service.

- The receiver’s bank account number, name, and other basic information.

- Government-issued ID such as a NIC or a passport to provide proof of identification.

- You may be asked to provide the purpose of your money transfer

You made it! That is all you need to know to send money abroad successfully!

As you see, there are many ways to send money internationally. Sending money abroad used to be simple, with few choices, but the explosion of options means that the process is now more complex. The upside is you can choose faster, safer, cheaper, and easier ways to live a global life. And, it also means that you have the flexibility to find your best way to transfer money internationally.

Thanks for these tips and for sending money abroad such as looking into hidden fees and poor exchange rates. I’m looking because my mom is hoping for me to send money to her in Uganda for her medical bills. I wonder if there are mobile apps you can use to easily do this.

All the apps above will be options for you.