What Is The Spanish Non-Lucrative Visa?

This article is from our sister site Moving to Spain and is reproduced here with permission.

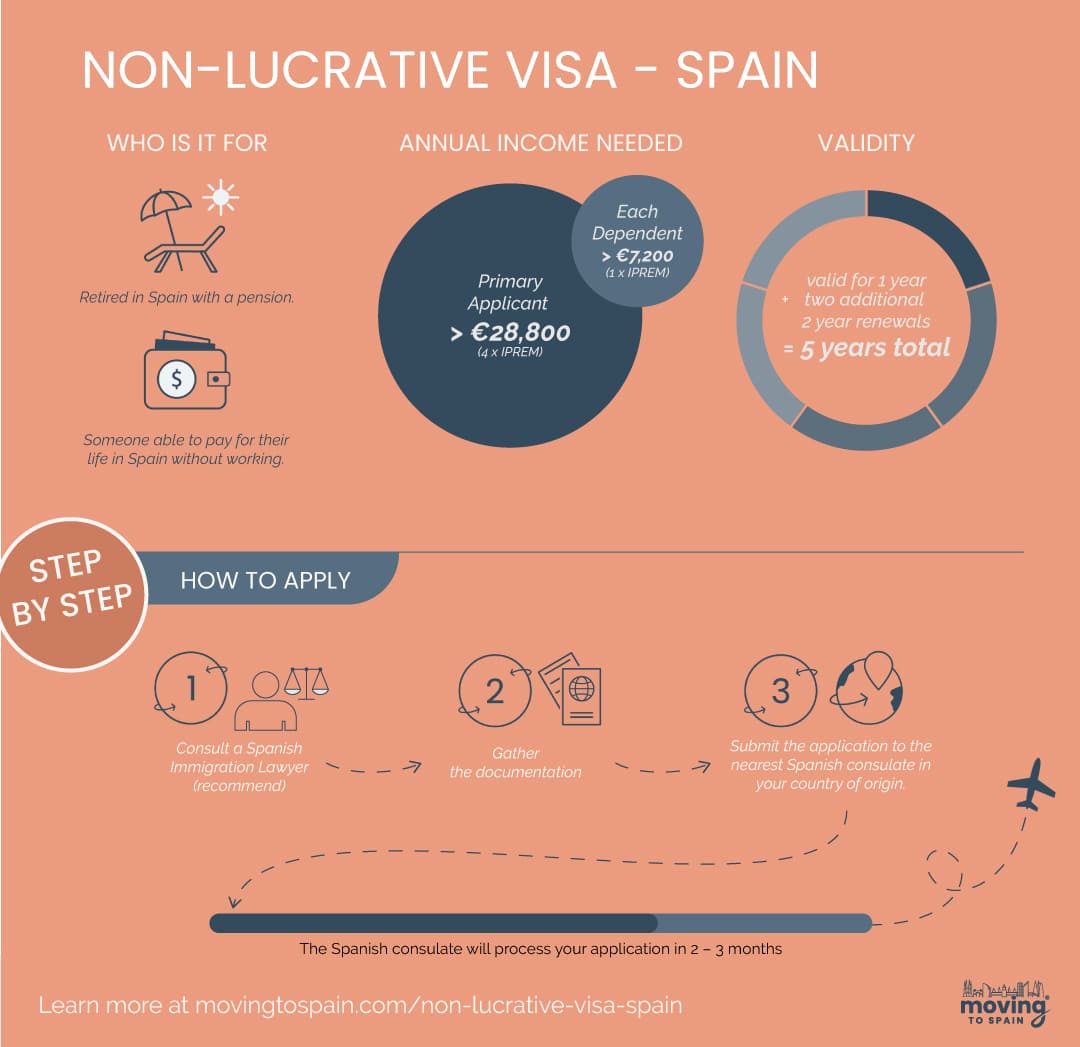

The Spain non-lucrative visa (NLV) is a long-term residency option for non-EU citizens who don’t plan to work in Spain. It is perfect for retiring to Spain as it requires passive income like pensions and investment income. For this reason, the NLV is often referred to as the Spanish retirement visa.

The Non-Lucrative Visa Spain Is Ideal If You Are:

- A non-EU/EEA citizen who wants to live in Spain.

- Retiring in Spain with a pension, annuity, investment income, or similar.

- Able to pay for your life in Spain without working.

Note: EU / EEA citizens don’t need a visa to live in Spain – there is a registration process for residency for any European citizen.

READ ALSO: Retire in Spain >> 2024 Visas, Health, Tax, Best Places & More

How Long Is The Non-Lucrative Visa Valid?

The initial visa is valid for one year. You can apply for two additional two-year renewals, so a total of five years. After five years, you can apply for Spanish permanent residency (which allows you to find work in Spain).

Note: There is sometimes confusion about the terms visa and residence permit. You have 90 days (3 months) from when the Consulte grants your visa to arrive in Spain. Once in Spain, your residence permit is valid for one year. You’ll need to apply for your TIE card and NIE once you are living in Spain.

2024 Financial Requirements For The Spain Non-Lucrative Visa

You must show sufficient worldwide income or sufficient funds without work income.

- Primary Applicant > €28,800 annual income (400% x IPREM)

- Each Dependent > €7,200 annual income (100% x IPREM)

| Non-Lucrative Applicants | 2024 Minimum |

| Single Applicant | €28,800 |

| Applicant + 1 dependent | €36,000 |

| Applicant + 2 dependents | €43,200 |

| Applicant + 3 dependents | €50,400 |

Note: The Spanish government uses a figure called IPREM to determine this requirement. The 2024 annual IPREM is €7,200 or €600 per month. The IPREM for 2024 has been carried over from 2023 as parliament has not approved a new figure. We do expect an increase when the budget is passed.

Acceptable Income For Your NLV Application

The Spanish Immigration Department accepts passive income for the application, so, income from sources other than work. The Consulate will be looking for stable, regular, verifiable income that exceeds the financial requirements. Common examples are:

- Rental Income: Money earned from renting out property you own. This could be from real estate investments in your home country or elsewhere, provided you’re not actively involved in the property’s day-to-day management.

- Example Evidence: Income statements from a property management company that handles your rental properties in the United States.

- Investment Income: Earnings from investments, such as dividends from stocks, interest from bonds, or income from mutual funds. These should be investments where you’re not actively managing the day-to-day operations.

- Example Evidence: Dividend payment statements paid out from a diversified stock portfolio.

- Pension Income: Regular payments from retirement accounts or pension plans. This is considered passive because it’s based on previous employment and not contingent on current work.

- Example Evidence: Monthly 401(k) or IRA retirement account payment statements.

- Social Security Payments: Government-provided payments such as retirement benefits, disability income, or other Social Security benefits that are received regularly. So, you can use US Social Security payments for your non-lucrative visa application.

- Example Evidence: Monthly Social Security retirement benefit statements from the US government.

Note: If you need to work after moving to Spain, you can change your immigration status. However, you must wait at least 12 months. So, after one year in Spain, you could apply for a Spanish Work Permit or Digital Nomad Visa.

Important: You’ll need to provide documentary evidence that your income qualifies. The exact documentation you need to show will depend on the income you are using to qualify.

“An example of the evidence, if it is a rental income, would be a copy of the property deed + rental agreement. If it is a pension, then the pension statement and bank statements may be necessary to show. We always have to submit documents regarding the origin of the income. These documents must be originals or correctly certified copies, depending on the documents and the Consulate.”

Raquel Moreno (LLB) – Spanish Non-Lucrative Expert Immigration Lawyer

Income That Will Be Rejected For A Non-Lucrative Visa Application

- Employment Income: Any money earned through employment, whether it’s from working for a company (either directly or remotely) or self-employment activities. The NLV is not intended for individuals who plan to work in Spain.

- Business Income: Earnings from actively managing a business or being self-employed, even if the business is operated remotely and not based in Spain.

- Temporary or One-Time Payments: Any income that is not regular or guaranteed, such as money earned from selling assets (e.g., stocks, real estate), gambling income, or one-time freelance gigs.

Can You Use Savings If You Don’t Have Income?

Our Spanish immigration Laywr partner advises yes, you can. However, you should have double the standard income requirement, so at least €60,000 in an account in your name. The bank account does not have to be Spanish, but this is preferable.

Does owning a home in Spain help an applicant? According to the rules, the short answer is no; it does not. However, this is another area where different consulates assess things in their own way. Some consulates take the reasonable view that owning a property in Spain that you intend to live in means you’ll need less money to live. And with a lower cost-of-living in Spain, it makes sense to require less income.

Other NLV Requirements

Qualifying Private Health Insurance

You’ll need medical insurance that meets 3 criteria.

- Comprehensive coverage without a co-payment.

- There are no waiting periods for any conditions beyond the start of your NLV residence permit.

- The insurance company issuing the policy must be registered in Spain and approved and authorized by the Spanish Immigration Service.

You can get non-lucrative visa-qualifying Spanish Healthcare quotes from our chosen insurers here. They even issue qualifying medical insurance policies in Spain for over 75s and clients with pre-existing conditions.

Additional Documentation

- A police record that shows no disqualifying convictions.

- A medical certificate to show you don’t have serious health issues. See the template below for a list of the issues that can impact you. Disqualifying conditions include serious infectious diseases managed by the WHO, drug addiction, and some severe mental illnesses.

Note: The Spanish consulate will only accept specific health insurance policies. The requirements for a non-lucrative visa application are very specific, and you must make sure that you meet those standards. The company must be registered with the government in Spain, the policy must be fully comprehensive without co-payments, and the coverage must be immediate without exclusions. You can read more in our guide to Health Insurance in Spain for Immigration.

Non-Lucrative Visa Spain Residency Requirement

There are two main NLV residency requirements that you should understand.

Update: In 2024, the High Court ruled that the residency requirement was unlawful as it was not specifically legislated. This means that you can maintain your permit without spending 183 days in Spain. As our immigration law expert confirms:

As of this ruling, visa holders do not have to follow the 6 months rule, so they can have the permit and not be tax residents!

Raquel Moreno (LLB) – Spanish Non-Lucrative Expert Immigration Lawyer

Warning: The Spanish government can appeal this decision or pass legislation reinstating the residency requirement at any time. We cannot guarantee that if this happens, your visa will be renewed with more than 183 days spent outside Spain.

Note: Prior to this ruling, you had to live in Spain for at least 183 days a year or just over six months. This duration in Spain can make you a Spanish tax resident. As a Spanish tax resident, you’ll pay personal income tax in Spain, called La Renta.

Note: To qualify for permanent residency (PR), you must spend ten months per year for five years in Spain.

How To Apply For Your Spanish Non-Lucrative Visa

We recommend using a Spanish Immigration Lawyer to ensure your application is approved. The application and documentation requirements are very specific, and rejections are common.

Important: You cannot apply in Spain. You must submit your application to the nearest Spanish consulate in your country of origin.

Documentation Required For Your Application:

- Proof of income or savings (like a property deed, rental agreement, or pension statement).

- Health insurance policy certificate.

- Medical certificate and police clearance certificate.

- Valid passport/s and certified copies of each page.

- Visa fees (€80 – €500)

- Two copies of the completed visa application form

- Tasas Extranjeria – Modelo impreso 790

- EX-01 – Formulario

“You should have all your documents ready for your application, but not too soon. Some documents can only be three months old when you put in your application. Also, some must be originals, and others can be copies but only with an Apostille certificate. Foriegn language documents must usually be translated into Spanish by an approved translator.”

Raquel Moreno – Spanish Non-Lucrative Expert Immigration Lawyer

Need Help with your Spain Visa or Residency?

Raquel and her team have helped over 600 of our clients with their visas, and we get fantastic feedback on their service. They offer a 30-minute consultation to confirm the best visa route for you, walk you through each step of the process, and answer any questions.

How Long Will The Application Take?

The Spanish consulate will process your application in 2 – 3 months. There is a second step to the application process. When you move to Spain, you must apply for your residence permit and TIE (residence card).

Remember: There are several factors in the time to process your application. The consulate, the time of year, and the workload are important and outside of your control. The biggest factor in your control is ensuring your application is correct and complete with all supporting documentation in order.

Can You Include Family Members On Your Application?

Yes, you can include family members in your non-lucrative visa application. Direct family members are eligible as long as you meet the income requirement. This option means you don’t have to make a separate family reunification application.

Note: Unmarried couples (and unregistered civil partners) must apply separately, each showing 400% of IPREM, regardless of how long they have lived together.

Spain Digital Nomad Visa vs. Non-Lucrative Visa Spain

The Spanish Digital Nomad Visa is an excellent option for non-EU citizens to work in Spain.

There are two significant differences between these two residency options.

- The Digital Nomad Visa allows professional activity for non-Spanish employers or clients.

- You can apply for a Digital Nomad visa while you are in Spain.

See more in our 2024 guide to Spain’s Digital Nomad Visa.

Note: Both visas are pathways to Spain permanent residency and Spanish citizenship.

Next Steps

Are you ready to get started on your Spanish adventure? Find out if you qualify and how to apply in a 30-minute call with our Spanish immigration law partner. They’ve helped hundreds of people worldwide secure their non-lucrative Spanish residency visa.

Non-Lucrative Visa Spain – FAQ

What is a non-lucrative visa in Spain?

A non-lucrative visa in Spain is a long-term residency option for non-EU citizens who do not plan to work in Spain. It allows non-EU/EEA to live in Spain as long as they are not working or earning active income. You’ll need to show you have enough passive income (pension, investment income, etc) to support yourself while in Spain.

Who is eligible for a non-lucrative visa in Spain?

Non-EU citizens who have sufficient financial means to support themselves and their dependents without working in Spain are eligible for a non-lucrative visa. Retirees to Spain with a stable pension, individuals with passive income, or those who can demonstrate sufficient savings are typically eligible.

How long is the non-lucrative visa valid?

The initial non-lucrative visa in Spain is typically valid for one year. However, it can be renewed for two additional two-year periods, totaling a maximum of five years. After five years, it is possible to apply for Spanish permanent residency.

What are the financial requirements for the non-lucrative visa in Spain in 2024?

To meet the financial requirements, the primary applicant must have an annual income of at least €28,800 (4 times the IPREM), and each dependent must have an annual income of €7,200 (1 times the IPREM). The IPREM figure for 2024 is €7,200 per year or €600 per month.

Can savings be used to meet the financial requirements?

Yes, savings can be used to meet the financial requirements for a non-lucrative visa in Spain. If you don’t have a regular income, you should have at least double the standard income requirement (€60,000) in a personal bank account. The bank account does not necessarily have to be in Spain.

Can I work in Spain with a non-lucrative visa?

The non-lucrative visa does not initially allow you to work in Spain. However, after residing in Spain for at least 12 months, you can change your immigration status and apply for a Spanish work permit or a Spanish Digital Nomad Visa if you wish to work in the country.

How do I apply for a non-lucrative visa in Spain?

To apply for a non-lucrative visa in Spain, you must submit your application to the nearest Spanish consulate in your country of origin. The application process requires specific documentation, including proof of income or savings, private health insurance, a medical certificate, a police clearance certificate, and a completed visa application form.

What income can I use for my Spain non-lucrative visa application?

Passive income that is regular, ongoing, and verifiable. This includes pensions, annuities, social security payments, investment income (rental income), and royalty payments. Unstable or on-off income sources (like gambling or asset sales), payment for work (salary, wage, commission, or fees), or business ownership income cannot be used.

What are common reasons for Spanish Non-Lucrative visa application rejections?

In our experience, there are three main reasons for rejection.

1) Insufficient qualifying passive income.

2) The Spanish Consulate can see you are working in the USA (or your home country) and believe you will work remotely from Spain. This can be from checking regular income on your bank statements.

3) You cannot get qualifying private health insurance in Spain.

Can I use US Social Security payments to qualify for a non-lucrative visa in Spain?

Yes, US Social Security payments meet the Spanish non-lucrative visa requirements of being passive, stable, and outgoing.

Hi.

We are a couple from Yerevan, Armenia. Both working in IT sphere remotely and we are interested in non-lucrative visa in Spain. By reading the information in your website I think we are eligible for this kind of visa (we have remote work and enough funds ). So there are a few questions I would like to ask:

1. Is our country in a list of eligible countries?

2. What other information can we provide in order to be sure that we are eligible?

3. What kind of help does your company provide in this process and what are your fees?

4. Can you provide a reference to an official governmental resource to read about this kind of visa from an official source?

Many thanks in advance,

Andranik

Hi Andranik, here is some information for you.

1. Yes, nationals of any non-EU country can apply and Armenia qualifies.

2. The exact documentation requirements depend on your situation. You must meet the financial requirements and how you prove this will depend on your source of income. You’ll need to show health insurance and get a health check. Finally, you’ll need a police clearance certificate. All documents must be translated into Spanish and all copies Apostilled. You must have everything 100% perfect and complete before you submit to avoid delays or rejection.

3. We partner with a highly qualified and experience Spain Immigration partner. We offer a no-obligation 30-minute consultation for €50 to explore your options – click here to book now.

4. Here is a link to the LA Embassy information page. Be aware, each embassy and consulate may have different requirements and that the requirements can change without notice. Using a good immigration lawyer will ensure that you understand exactly what is required and maximise your chances of success.

Hi Alastair!

I’m also interested in applying to this visa. I’m a Lebanese citizen and I will be working remotely starting August for a monthly basic salary of 2800$. I also have around 5000$ In cash that I can deposit whenever needed in my bank account.

Am I considered qualified for this visa?

Thank you!

Hi Malak. We’ve just had an update (30/06/2021) from our legal partner in Spain. Applications with remote work evidence are being rejected at present, and we have requested and are awaiting clarification. We’ll be updating our articles today to reflect this change. You can checkout some other remote work visa options. Our partner has advised that for remote workers there is still the possibility for a Spain self-employed work visa depending on how the employment is structured. Regards, Alastair

Hi Alastair,

Many thanks for your reply. This helps a lot!

My work contract is an international contract that allows me to work from any place of residence as long as I abide by the taxation policy of the country of residence. My contract, however, is for an international humanitarian organization so there are no investments being made (hence not sure if this qualifies me for a self employment visa).

Thank you again for your help!

We have a non lucrative visa and we own a house in Spain which we live in. Does the non lucrative visa permit us to buy a second property in Spain to rent out for short term lets? That does not take jobs away from locals, so does it count as economic/professional activity (not allowed) or as investment (allowed)?

Thanks

Hi Phil – there are no restrictions on Expats purchasing property in Spain and it won’t impact your NLV status. All the best, Alastair

1. Do you need an address in Spain first to apply for the non lucrative visa?

2. Are savings in Premium bonds/savings account exempt from any tax implications if used to drip feed into a current bank account?

3. Is there a maximum age limit to apply

Thank you

Hi Sally. Here are the answers to your questions.

1) No, you can apply for the Spain non-lucrative visa from your home country.

2) Your tax implications will be specific to your case. Once you are resident in Spain for more than 183 days per year then you may be liable for Spanish taxation in some cases. Best to seek specific advice for this.

3) No, there is no maximum age limit as long as you meet all the visa requirements you are welcome to apply. In fact, many retirees use the non-lucrative visa as a Spain retirement visa.

Hi there, I have had conflicting advice and need clarity please. I am.applying for the NLV and will be buying a place to live and 1 or 2 places to rent via air b and b. Does the rent class as passive income and therefore be acceptable under the NLV Rules? Also will i need to pay tax on this in Spain? We can prove enough income for the first year for the NLV requirements so hopefully this will be an enough to be accepted? Jo

Hi Jo. If you home is worth more than €500,000 the Spanish Golden Visa may be a good option. Our NLV expert Immigraisotn Lawyer will be happy to assist with your application.

Rental income should be considered in your application as it classifies as passive. Where you pay tax (and how much) will depend on your tax residency and status – if you have tax questions I’d suggest meeting with a Spanish tax expert – you can book a consultation with our partner, Daniel, here.

All the best, Alastair

Hi. Great summary. Much appreciated.

We are a couple in the US that would eventually like to retire in another country (in about 10 years). We have narrowed it down to two: Spain and Portugal. We both are fluent in Spanish and get by with Portuguese. We’ve been in Spain on vacation and loved it, and we are planning to go to Portugal sometime soon.

I am an IT software architect and have been working remotely for a US company way before work-at-home became prevalent here in the US given the COVID situation.

But, before we settle in a country, we’d like to “try them out” first. We have been exploring the non-lucrative visa in Spain, and it will fit the bill as we have enough savings to cover the core requirements. But also I will need to continue working remotely while there. I understand that the remote-work aspect is a very gray area, but it is something we want to explore more. My wife will not work, although she may qualify as an English teacher.

So, my three main questions are:

1. Can I move around Spain and live for two or three months at a time in a particular area with this visa? The idea here is to try each region for a bit to see which one we may eventually settle in.

2. Will Spain allow in the near future digital nomads like myself? Given the economic impact the COVID situation has caused, many countries are loosening the visa restrictions to allow people like myself work remotely. I understand that in Portugal they are seriously discussing this, and other countries have already implemented it (Barbados, Costa Rica, UAE, etc.). It makes sense as you are not taking jobs from local citizens but you are spending money there, helping with the economy.

3. Our ancestors are from Spain (about 4 generations ago). I heard that Spain has a different set of rules for people that are from former Spanish colonies, and can “accelerate” the visa/residency process. Any thoughts on this?

Thanks. Again, great article.

Nelson & Jackie

Hi Nelson and Jackie. Here are some general replies without knowing your circumstances fully. Your best bet would be to book a no-obligation consultation with our Spain immigration lawyer.

1) Yes, you can move around Spain on a non-lucrative visa.

2) Many European countries are moving to attract digital nomads, but Spain has not announced any concrete plans as yet.

3) Spain has accelerated naturalization for citizens from ex-Spanish colonies. You can qualify in just 2 years if you come from one of the qualifying countries. See our Spain Citizenship page for more details.

Will I have to pay taxes in country where remote work originated as well as taxes in Spain if on a non lucrative visa?

Hi Fran. This is general information, and you should check your individual circumstances before making any decisions. Having said that, Spain has tax treaties with most countries. This means most people are not liable for double taxation, those tax-resident in Spain declare income in Spain and are taxed in Spain.

Can i learn spanish language to integrate and work remotely with non lucrative visa?

The non-lucrative visa does not legally allow you to work. However, you can certainly study Spanish to allow you to qualify for another visa or permit if you want to work in Spain.

HI! If I do not have a lot of savings in the bank, but can prove that I have reliable sources of monthly income such as social security, pension and annuity, with a total of more than $35,000 per annum, do I qualify to apply for the non-lucrative visa?

Hi Maria. Yes, as long as you can meet the minimum amount for the non-lucrative visa (currently €25,816 per annum) you can apply. You don’t need savings if you can show a guaranteed income.

Is our pension considered income? will it be taxed?

Hi Chris. Yes, pension income is accepted (and very common). The non-lucrative visa requirement is that you live in Spain for more than 183 days per year, and this may make you tax-resident in Spain. However, you won’t be double-taxed as Spain has tax treaties to avoid this.

Hi Alastair, thanks fot the useful info on your site.

I have a question about the renewal of the NL residency. For the IPREM I would need around 52k Euros. I have a permanent income of around 19k Euros PA, would my financial requirements to renew be accepted if I had 38k Eu as income and the other money in the bank as savings? I can easily meet the requirements for my first year, but if I decide to buy a little place of my own this will affect how much is left in my savings. Does this make sense?

Hi Jason. As you don’t meet the income requirement it will be best to chat to our Spain immigration partner to decide on the most effective way to frame your situation for the best chance of success. Regards, Alastair

Hi, Alastair.

We’ve both recently retired and we’d like to eventually retire to Spain. obviously since brexit we’ll need to apply for a Non-lucrative visa, and until my wife is eligible for her State Pension( June 2024) we just have my work pension, which is approximately €28.5k at the current exchange rate which I know is a little below the sum required for guaranteed income for a couple, but we also have savings exceeding £100k. so if I’m reading this correctly? The sums quoted are an either, or scenario, as in savings or income? Also would the fact that we already own the house (mortgage free) in Spain that we’d like to move to be taken into account as we’d have no mortgage/rent payments to impact on the guaranteed income side of things?

Many thanks, Tim

Hi Tim. Your case for a non-lucrative visa looks to be strong. Your income is, as you noted, just under the approved amount. However, I would suggest discussing your case with a Spanish immigration professional before proceeding to be sure.

Hi Alistair,

Thanks for your reply, I thought we had a reasonable case, but it’s nice to hear that you think so too, and when we’re ready to start the process, we’ll certainly look to follow your suggestion and take some professional advice before applying.

Many thanks again,

Tim

My wife and I, both US citizens, are considering the purchase of a second home in the Canary Islands. However, we are concerned about becoming tax-residents of Spain. Because we are retired, our “income” is from pensions, public and employer-based, and from savings, IRA’s and other investment accounts. For our “income”, the tax rates in Spain appear to be higher than in the US, particularly when you take into account that our IRA funds are not taxed until withdrawn. Does Spain tax dividends and interest in IRA’s? Does Spain tax pensions, both public and private? Thanks.

Hi William. The Canary Islands are an amazing retirement destination. We can’t give specific taxation advice,. I’d strongly suggest speaking to a qualified professional to understand how your personal circumstances will impact your financial postiion.

Hi there,

I have considered a non-lucrative visa for my planned relocation to Spain within the next few years, but having read this, I don’t think it’s right for me. Currently I’m freelance and my clients need to pay in GBP into a UK bank account (so autonomo probably won’t work for me). I’m worried about the legalities of using a UK address and bank account to earn money while being resident in Spain, and which type of visa I need.

I have an alternative option: I have been offered a job with a UK company (working remotely). I suspect it would be easier for the employer to pay me into a UK account, but then that creates the same worry as above – having a UK bank account and not being resident in the UK. And again, I don’t think a non-lucrative visa would be the best option for this.

Hi Jo. YOu can’t legally work on the non-lucrative visa and BREXIT has complicated UK/ Spanish relations. I’d suggest chatting to a qualified Spanish immigration expert to understand your best options.

Hello Alistair, my daughter is a resident home owner in Spain along with my two granddaughters. I’m 50 is there any way that I can be classed as a dependant or be a primary carer ?

Kind regards

Simon

Yes, there is a provision for dependent family members that you may be able to use. It would be worth exploring your options with a qualified professional. You can chat to our Spain immigration partner if that would be useful for you.

I am a UK citizen came to Spain in November. I know I can stay 90 days from Jan 1st with Brexit but now that I am here and the situation is what it is in the UK and with travelling etc I would like to apply for the non lucrative visa. I have the funds, I could get the insurance policy but from what I have read it seems the only way to apply is if you are in the UK. Is there a way around this as even if I went back to the UK now I couldn’t travel to any embassy or consulate to apply. Or is there an alternative option now that I am in Spain? The residency option seems quite complicated and not such a good alternative for potentially only a one year stay.

Hi Cass. Yes, you do need to apply for the non-lucrative visa form your home country. Please check out our guide to other Spanish visas and residency options to find a fit for your circumstances. Or, book a no-obligation consultation with our Spain immigration expert here.

Hello,

I am considering taking a year away from life in the USA to spend a year in Spain. I am 31 and would be leaving my current job as a math teacher.

I know I need the 28k, but I have heard differing things on how long I need to have that money in my account. I currently ha e the needed money in a brokerage account, and was planning on selling stocks to get myself up to the 28k needed about a month before applying. Will this work?

Hi Andy. The Spanish immigraiotn serive are looking to see that you can support yourself for the duration of your stay. For this reason the NLV application should show steady passive income, not just savings to the iPREM level. All the best, Alastair

Hi does this non-lucrative visa allow you to come back and forward in and out of uk? I am a Live-In Carer I work 2wks in Uk then home to Spain for 2wks

Hi Louise. You can indeed move freely on the non-lucrative visa. However, you cannot legally work on this particular Spain visa.

Great article. many thanks.

I was looking at a non-lucrative visa however I feel my circumstances may be complicated.

I work for a UK company and will be working remotely. I earn around 60k a year but some solicitors have said I can include this as income and others have said no.

I have a house in the UK and will be renting that when I move to Spain.

I do have a criminal record that they class as serious, although at the time of conviction, this was not an offence in Spain although I believe it is now.

My questions are as follows.

1) Can I use my income as I will be working remotely, I intend to move to Murcia

2) How can I prove rental income as I won’t be receiving the income until I rent the house out which will be when I move and visa will need to be in place by this time. Will a rental agreement be sufficient?

3) Will my criminal record automatically mean I will be rejected. I was convicted in 2012

Many thanks

Hi Mark. I agree, your circumstances may be a bit complicated. You’d be best off discussing your specific circumstances with a qualified Spain immigration lawyer. You can book a meeting with the Where Can I live partner here.

Hi. Thanks for sharing the information. I live in the Netherlands and my parents are from non-EU country. Now they can only stay with me for 3 months every half an year. We are exploring the options to get them EU residence permits and eventually live with me in the Netherlands. If they are able to get this non-lucrative visa, do they have to live in Spain for 183 days for the first year? And how many days each year do they have to live there after the first year? Thanks a lot!

Hi Lexie. To renew your non-lucrative visa you need to have spent 183 days per year in Spain. The visa is valid for 1 year and is then renewable for two x two-year extensions. This gives you the five years you need to apply for Spanish permanent residency.

Hello Alastair. Not only you’re very clear with the information, but your availability to keep answering doubts here in the comments section really impressed me. Thanks for all of that.

I’ll be completely frank to you with my doubts, plan and situation and any advice you can give me will be very handy.

I’m 33 years old, I have a small passive income generated by rented properties (definitely below the 4x iprem rule) but with the practice of saving and investing throughout my life, which granted me today a liquid amount in bank savings of more than 2 years of the requested by Spanish authorities for this kind of Visa.

My plan: I’d like to apply (no doubts about the first request of the visa – I think I’m able to get it), live in Spain in a very frugal manner, in a way that I can manage myself with the short income of my rented properties and go on that way until I’m able to request citizenship (I can count with the shorter time benefits for requesting it, for ibero american citizens).

My doubts finally are:

1) do you think I would be able to renew my visa by showing my savings (or showing the same savings again, once that I would be showing the same “frozen” account I would had shown in the first time I would apply for this visa, but of course in a updated – and probably a little incremented in total amount value – document), even if the history of my Spanish bank account have a (much) lower traffic than the 4x iprem rule?

2) once that my yearly earnings are low, and considering that I’ll be taxed for it in my home country, would I need to also proof to be ok with Spanish taxation during the renewal? Is there an amount of yearly generated money that is exempt of taxation in Spain? Do you know if by filling taxation in my home country, can I avoid the necessity of filling to taxation also in Spain?

Thank you very much for any possible advice. Sorry for writing this much and hope to see your thoughts. My compliments,

Hi Jose. Where your circumstances don’t fit the exact requirements we strongly suggest talking to a qualified immigration specialist for the best advice. OUr Where Can I Live partner for Spain has a great track record with successful non-lucrative applications. Book a consultation here: https://wherecani.live/services-tools/immigration-lawyers-spain/ Again, this is a general comment, but the renewal of the visa is sometimes simpler than the primary application because Spain has already accepted your position – so, make sure you are 100% prepared and covered for your primary application and you should have a smooth renewal process.

Taxation can be tricky so this is advice not specific to your situation. To renew your non-lucrative visa you must live in Spain for more than 183 days in a year, and generally, this makes you a resident in Spain for taxation. Be aware, this is general advice and you’ll need to discuss your exact personal circumstances with a taxation specialist. However, Spain has excellent tax treaties, and so the vast majority of people are not subject to double taxation, even if they have to submit a tax return in both countries.

Good luck with your application and we hope to welcome you to Spain soon.

Thank you very much! As I get closer to the time I wish to apply, I’ll surely look after specialized help and orientation. Your comments are important for keeping me with hope. Wish you all the best

Can i apply for the Visa once im in spain? Im English, currently living in France and intend to move to spain in about 10 days or so. Im hoping i can apply for this in Spain as i going back to the UK right now is going to be slightly difficult

Hi Sam. You cannot apply for a non-lucrative visa from Spain. You have to make the application from your home country before moving to Spain. However, if you are resident in France, you may be able to apply from the Spanish Consulate or Embassy in France which means you won’t have to return to the UK. I suggest you book a consultation with our Spain immigration experts to find out how best to proceed to give you the best chance of success.

Hi, Myself and my partner have British passports but have permanent residency in Malta.

Can we apply for residencia using this as it is EU to EU country or do we have to start again and get the non-lucrative visa?

Hi Alison. In general, as a non-Eu citizen, you’ll need a residency or visa specific to the EU country you want to live in. However, it would be worth discussing your situation with an immigration expert to see if there is any advantage with your Mata residency that can help you. Book a consultation here. Good luck with your move.

Good afternoon, could you please tell me what the financial requirements would be after the 5 years period staying in Spain on a non-lucrative visa? I am considering applying, I would have access to the required funds in a joint bank account, is this permitted? My husband also has a company pension, but I do not have an income of my own,until I have my (state) pension in 5 years time.My husband would not want to take up residency, but would join me in Spain for periods of up to 90 days, as he is allowed to do. So, would I have to keep showing the required amount in the bank after the 5 years, when I applied for permanent residency? , or does this requirement end then. Many thanks for the information.

Hi Jackie. Once you are a permanent resident there are no income requirements.

Thank you for your reply. Could I ask another question, please? When I qualify for my state pension, if I have been resident for over 5 years, can I then pay into the Spanish health care system, or must I continue having a private policy? Thank you for your most helpful information.

In general, you need to be a Spanish national or paying social security to be eligible for state healthcare. So, if you went direct from a non-lucrative visa to PR and didn’t work and pay social security, you’d need to have Expat health insurance. If you took Spanish citizenship when you qualified after 10 years, you would then be entitled to healthcare.

Hello Alistair.

I am considering applying for a non lucrative visa and have several queries.

1. If I have the visa and stay over 183 days and classed as a resident and under the Spanish tax system. Would the tax I pay in the UK be still payable in the UK due to the double taxation rule.

2. If I have an annual travel insurance purchased in the UK which covers me for 90 days per visit (I will visit the UK just within the 90 days to reset the qualifying period) and the new GHIC card which covers me in Spain is the requirement for Spanish insurance still applicable.

3. If I sell my home in the UK, which would be free of all tax implications, would it be liable to Spanish taxation. Again would the double taxation rules apply.

4. If, after a year I decide to work in Spain and pay into the system both in tax and insurance, how long would it take to be covered by the Spanish health and social systems.

Thanks and regards.

Bob

Hi Bob. I can only give advice that is general in nature. I am not a qualified tax consultant and so you need to check your specific situation.

1) Spain and the UK have a taxation treaty and so, in general, you are not taxed twice on any income.

2) Travel insurance will not be accepted. You’ll need comprehensive health cover in Spain. Check out our article on Expat health insurance.

3) Again, you should seek advice specific to your situation. In general, the UK/Spain taxation treaty avoids double taxation.

4) Once you or your employer are paying social security on your behalf you may be eligible for Spanish health and social programs. Be aware, not all visa and residency permits are eligible for these programs. To get a better idea of the best pathway for your situation it would be best to talk to a local immigration expert. You can book a consultation here.

Hi my partner and I are looking at applying for the non-lucrative visa I just have a few questions before we book a consultation please:

1) how long is the application process in consideration of the covid pandemic?

2) we will be applying based on savings in the bank, how long do we need to have had the money in the bank for, to apply?

3) to renew the visa after the first year (I understand it’s double the savings amount) how long does that need to be in the bank to apply?

4) what are the fees for applying for the visa from the Uk including lawyers fees (just roughly is fine)

Thank you

Hi Karen

Approval times vary at the moment, but 2 – 4 months is not unusual. For your financial requirements and fees, it will depend on your circumstances so the consultation will clear up those questions.

The consultation has no obligations and we are confident in the value and quality of our partner. Indeed, if you aren’t happy we offer a 100% money-back guarantee on the consultation.

Thank you for your reply we’ll book a consultation.

Hi

My wife and are both 70, we have a joint pension income after uk tax of €29,500 with cash in the bank of €268,000 , we would be looking to buy once in Spain.

Would we qualify for Spanish Non Lucrative Visa

Hi Alan. Although your joint pension comes in just under the recommended level, your savings are considerable. I’d suggest having a chat with our Spain Immigraiton lawyer to find out the best way forward for you. There is no obligation, and a 100% money back guarantee if you’re not happy with the service.

I am applying for a non-lucrative Visa and would like to switch to a work visa after a year. Do the same conditions for this visa apply ie job must have been offered to Spanish/EU citizen first, or would I be classed as a resident? Thanks!

Hi Lily. Yes, you can freely change from a non-lucrative visa to a Spain work visa after the first year. However, you’ll still be subject to the standard work permit conditions. Not all jobs and not all work visas have an EU-citizen first ruling. Check out the link above for more details on your options. Alternatively, book a no-obligation consultation with our Spain immigration lawyer.

I’m looking to move to Spain from the Uk in the next few years, however I’m not of retirement age so would need some form of income. I’m hoping to buy a property in Spain and be able to rent out rooms in the property for holiday rentals, would I be able to do this on a non lucrative visa?

Thanks!

Lily

Hi Lily. You can’t run a business on the non-lucrative visa. But, the Spain self-employed work visa may be a good option for you to explore.

Could I ask a clarification point? If we purchase a property which could eventually be run as a B&B, could we spend the first year renovating it and then apply for a work visa after one year? Also, there would be three adults (couple and mother), so would all of us need to convert to a work visa or only the main worker member of the family? Additional point of clarification, one of us would still like to do overseas consulting work (physically going to work outside the EU, not remote consulting). Would that be allowable under the NLV? TYIA.

Hi Mark. Yes, you can apply to move from a non-lucrative visa after the first year. Check out your Spain work permit options here. Who needs to change residence status will depend on how you run the business and who is considered to be working for the business and paid by the business. The spouse and parent of a successful work permit applicant would be eligible for a Spain family reunification visa as you’ve lived in Spain for a year already. For the last point, I would advise clarifying with a Spain immigration lawyer as remote work is not 100% clear in the legislation and the specifics will make a difference.

Hi, I’m only on the state pension of £184.71 per week (£9,604) per year.

I have £ 285,000 in the bank. I want to purchase a house in Spain and know that I can only stay there for 90 days maximum (180 days per year?).

What are my chances please.

Thank you.

Norman Collis

Hi Norman. You are under the threshold for the visa and so you’ll need to explore your options. You can book a consultation with our fantastic Spain immigration lawyer and they’ll be able to assess your options.

Hi, As a married UK couple can one of us apply for the non lucrative visa with the other classed as a dependent? We meet the threshold for funds from rental properties in the UK. My questions are:

With the double taxation agreement does this mean we wouldn’t pay income tax in Spain as we would continue paying this tax in the UK?

Would we be taxed on worldwide assets in Spain? We have a property portfolio in the UK & are concerned about this, we would be living in our house in Andulcia.

Thanks.

Hi Claire. Yes, you can include your spouse under your visa. Taxation is very dependant on your specific circumstances and we advise speaking to a trustworthy tax specialist before making decisions – this advice is general in nature. In general, as a tax resident of Spain, all your global income may be liable to be taxed in Spain. And, in general, taxation treaties mean that this income will not be double-taxed so paying tax in Spain means not being liable to pay tax in the UK.

After 5 years can you continue with a non lucrative visa if you don’t want to take residency. If you take residency do you have to pay taxes in Spain.

Hi Peter. Yes, as long as you qualify, you can renew your non lucrative residency permit. On tax, this is general advice and you should check your personal situation with a taxation specialist. You need to live in Spain for 183 days of the year to qualify for a renewal of your residency permit. This can make you a tax resident of Spain in many cases. So, you may be liable to pay tax in Spain anyway. Happily, Spain taxation treaties to ensure you are not liable for double taxation.

Hi Alastair,

I’m an Indian is it fine if i show funds(threshold requirement) in savings account of my Home country,is it mandatory to show any proof of income as i do not have any income at this point of time

Hi Eshwar. The Spanish government wants proof you can support yourself. In general, that is done by showing an income. However, if you have extensive savings that clearly will be more than enough to live on for the life of the visa, then it is possible to be accepted. However, it is certainly not as straight forward as showing steady income.

thanks for your reply Alastair

Hi Alistar,

If I have referral income for clients I have referred to a company in the past and that company will give me a referral fee if any of them convert is that allowed? will that be considered active income or passive income?

Hi Robert. That is a very specific situation. Your best bet is to chat with a Spanish immigration lawyer to assess your case before your application.

Can Algerian with enough founds apply for the Visa-Non-Lucrative?

Do I need to be physically in Spain to apply?

To what Spanish institution is this application going to be sent?

How can I verify that you are accredited to send this application on my behalf?

Hi.

1) Yes, there are no restricted nationalities.

2) You cannot apply in Spain, you must apply at your nearest embassy or consulate.

3) The Spanish immigration service will manage your application through the consulate/embassy.

4) Our Spanish legal partner is a full certified member. They will work with you to ensure you get the best outcome. Our initial consultation is 100% refundable if you are not happy with the service.

Hi Alistair,

We are a married couple with savings of £40,000 in the bank, my uk state pension doesn’t start until July this year but we do own our house in the uk that we rent out for another £500 per month, will we be eligible for a non lucrative visa if we apply now.

Thank you

Martin.

Hi. The £500 per month is under the limit, but with the savings and your future pension, you’ll more than cover the requirements. As to the best timings for your application, it would be best to chat with Spanish immigration lawyer to agree on an effective strategy.

Hello,

a question regarding the 183 days required to be spend in Spain during the year to be able to renew it. Is it necessary to be there physically or just to have an home address in Spain for more than 183 days?

Thanks – Regards,

Miki

Hi Miki. The ruling is that you are present in Spain. If you maintain a home address and pay taxes in Spain that is the key. If your application had any issues you don’t want any reasons for it to be rejected. Given that you have free movement through the SCHENGEN area you’ll have no immigration records as long as you stay within the zone.

Hi Alistair

I have recently taken out residency in Spain and my fiancee would like to join me. She has over £100k in savings but is currently not working. The plan would be to apply for this visa and spend at least 183 days in Spain but would like to work in the UK for a four month period. Would this be allowed under the terms of the visa?

Also, would she be able to travel to other schengen countries and, if so, would she be limited to the 90/180 day rule? If she had a UK-registered vehicle with her would it need to be matriculated onto Spanish plates under these circumstances and would she need to exchange her UK driving licence for a Spanish one as I have? Regards, Paul

Hi Paul. The specifics of your case would best be discussed with an immigration lawyer.

Alastair

Does the 2nd/3rd year requirement of 8 x IPREM have to be evidenced that you have the sum at the time of application or can a guaranteed pension x2 ie a pension sum covering the two years be acceptable.

Thanks

Hi Tim. A monthly pension will be accepted.

Thanks Alastair. Are the figures quoted before or after tax?

The figures are before tax

Hi Alastair,

I’m originally from Hong Kong, been living abroad 30 years, presently living in France since 2010. I intend to continue living in France with my French PR, at the same time spending times in Spain while my son studies university in Barcelona from September 2022. The Spanish non-lucrative visa is a great chance for me to open up future living long term in Spain. Financially I meet all the requirements but still have a few questions:

1) Instead of applying for Student Visa, my son can actually benefit if I apply him as my dependent of the non-lucrative visa. After living / studying for 5 years, not only myself, he will also be eligible to apply for his own Spanish PR. Am I correct?

2) In my case, planing to live in/out between France and Spain, how can I prove myself living 183+ days in Spain since there is no specific immigration check each time when I go through EU countries. Any advice how should I prove?

3) Since I am presently living in France, how can WHERECANI.LIVE helps if I need lawyer assisting my application?

I appreciate your advice. Thank you.

Hi Cecelia

1) yes, your son can study in Spain as a dependent on your non-lucrative visa and qualify for PR after 5 years.

2) As long as you have accommodation in Spain, and register in Spain for tax residency that should be sufficient for the renewal. It would be worth exploring this with your lawyer to clarify the requirement 100% for your circumstances.

3) Our Spain immigration law partner will be happy to assist you remotely. They’ll be able to give you the best way for you and your son to live and study in Spain.

I plan to continue my children’s UK education through online schools based in UK, will this be accepted as full time education for the renewal process after 12 months.

Hi David. You should check the UK school details with your immigration lawyer to ensure that the registration will be accepted.

Hi Alastair – myself and my wife are both planning to apply for the non-lucrative visa.

1) Can the application be made for 2 people as a couple on 1 application or do we need to each complete an application..??

2) If we both have to complete an application can we both use details of a joint bank account in both our names and also a pension fund in my name as proof of income – as my wife would be classed as my dependent…?? i.e. would I have to prove approx 25,000 euro income and my wife approx 7,000 euro income as a dependent….?? Or would we both have to prove we have approx 32,000 euro on both individual applications which could be from a joint bank account and my pension fund…??

3) Once we move and buy a property we are planning on living in Spain so becoming tax resident, etc. Is it better to take any tax free lump sums from any pensions held in the UK before becoming tax resident in Spain. Or if using a flexible income draw down from a pension fund after becoming tax resident is the tax not affected too much anyway due to the double taxation deal….??

4) The application for the non-lucrative visa states proof of income in a bank account, etc, for 6 months prior to application…?? Could this be shown by having the applicable funds in a pension fund which has held this amount for 6 months…?? And this proof of pension fund be used for both myself and my wife’s applications…??

Any advice on these points much appreciated.

Thank you –

Richard.

Hi Richard.

1) You can apply as a couple, or as an individual with a dependent. Best to have an immigration lawyer assess your situation to see which path has the best chance of success.

2) It is very hard to give any reasonable taxation or financial planning advice without an overview of your entire financial situation, sorry!

3) The pension fund’s income should be sufficient evidence. The main thing is to present an application that, in totality, shows you are capable of supporting yourself for the duration of the visa.

All the best,

Alastair

Hi Alastair – thank you for the reply.

As a loose time-frame when should we actually send in our application to the Spanish consulate in the UK….??

Do we need to have 6 months of sufficient income shown in a bank account or held in savings prior to first applying or is this presentable to the consulate at the time of the interview….??

Or do we send in all supporting documentation at the time of the non-lucrative visa application, including proof of income and proof of medical insurance and criminal record check….?? Are these all sent at time of initial application…??

It’s just that with some of the documents only valid within 90 days – is that 90 days of planned travel to Spain or valid within 90 days of application…??

Many thanks –

R.Savage

Hi Rich. You’d best discuss this with an Immigration lawyer to ensure all your timings work out. Depending on the embassy or consultant, processing times can differ.

We are a retired couple and for the last five years been travelling Europe, if we commit to the visa and 183days in Spain will I have to relinquish my UK driving license and convert our Motorhome to Spanish plates or is that only after the five years

You’ll need to register your vehicle in Spain if you are resident in Spain – this EU page has details. You will need to change your UK license for a Spanish license. The exact processes not yet 100% clear.

Hi – very interested in the Spanish non-lucrative visa for myself and partner. We own a house in Spain already. Our current retirement income is low as from early pensions – about £14,000 PA but we have savings of £130,000 [and could also sell a property in the UK for more] we are 55 and 60. Expecting further pensions later too.

A Yes or a NO??

Thanks!

Probably a yes, but you’ll need to check on the best way to manage the application. Your home in Spain doesn’t count towards the income or investment levels if you are living in it. If you get rental income from the properties, that could help. Our Spain immigration lawyer partner will be able to advise on the best approach for you.

Hi Alastair, if I am living in Spain with the NLV and I decided to open a local business say a cake shop and myself will be working there (I have many years of work experience in F&B), my understanding is that I could apply for a modification of residence permit to an self-employed one (Autonomo), and I would have to write a business plan and show sufficient funds to run the business. My question is, in your experience, is that a difficult process? how long does it take? have you had any clients in similar situation and succeed? Lastly, do I have to wait until after the first renewal of NLV before applying for the change of residence? Will I have to renew the autonomo residence every year? Thank you very much!

Hi, Henry. With your experience and the assistance of a good immigration lawyer, you should be fine to qualify for the self-employed work visa. Approval times vary and depend on the completeness of the application as well as where the application is submitted. You can’t apply for a change of status until after the first year of the non-lucrative. Your immigration lawyer will be best placed to advise on the optimum timings for gathering documentation and submitting the application. The renewal is annual, and sufficient funding and business progress are the normal renewal requirements.

Hi Alastair,

1. If my current company give me a freelance project after I resigned from my country. Within the first year of non-lucrative visa, any recommendations how I can get this income?

2. Do you help client to apply for a Spain work permit visa after first year of non lucrative as a self-employed individual? What’s the minimum budget I need?

3. Can I work in other countries while I’m holding a non lucrative visa? Eg: let say a project that I need to travel to other EU countries to work? Would this be possible?

Hi. Remote work and freelance work is a grey area for the non-lucrative and you should discuss your best options with a good Spanish immigration lawyer.

You can apply to switch from a non-lucrative visa to any work visa after one year. Yes, our Spain immigration law partner can assist – please click here for more information.

Hello. Well written article. Thank you for that. However, I think you might have a typographic error in one of your sentences on remote work. Here is the sentence: “There is no provision for remote work in the legislation, but it does fit the intent of the legislation.” Did you mean to say “…but is does NOT fit the intent of the legislation.”??

The non-lucrative visa encourages people who can support themselves (without taking a job from someone in the Spanish workforce) to come and live in Spain. Remote work means you’ll live in Spain and bring money into the economy.

Hello. My husband and I will be moving from Canada to Spain in just under a year. Starting to work out all the details now.

My two questions:

1- I work for a Canadian company and work from home, my company have agreed to still allow me work from home when we move. Would Spain allow this since I am not working for a Spanish company or taking any Spanish jobs. I am not an EU citizen

2- My husband is an EU citizen does that automatically make me one being his spouse or do I still need to apply for a non lucrative visa.

Thank you

Sam

Hi Sam. Your husband can move to Spain as an EU citizen and you can move as his dependant. Your remote work may require a Spanish work permit, depending on the conditions. IT would be worth it to check with a Spanish immigration lawyer about the best way to proceed.

Thank you. I actually didn’t think my message got posted the first time so I asked again. Sorry about that.

I already have a home in Menorca and want to stay in Spain for about 183 days a year. I’m not sure if the 183 day minimum stay requirement is for every year or just the first year that you apply for the non-lucrative visa?

Many thanks

Rick

If you want to renew the visa, you must have met the residency requirement in the previous period.

Hello!

I am 59 years old, live in the UK, and am considering retiring to Spain when I reach 67, but I am unclear on the non-lucrative visa requirements. I will have savings of about 50,000 euros by then, which I can show in a bank account, and I will have enough to buy a small property as well, but my actual weekly income will be just the £175 state pension from the UK, or a little more. I’m very frugal and am sure I could live on that, but what I don’t understand is, do I need to show an INCOME of 30,000 euros a year (impossible!), or just to show the 30,000 euros in a savings account every year, which hopefully I wouldn’t need to touch? I hope you can clarify!

Hi Fiona. The initial application is looked at as a whole, and the government wants to see that you can live at the level of 4 x the PREM. Unfortunately, your spending levels are not taken into account. Both income and savings can be used in the application and in future renewals so if your frugality keep the nest egg in place that is great.

i understand that in spain i must purchase spanish health insurance with no copay for a year in order to receive an NLV. is there any point at which i can move to the spanish national health care system? at 1 year renewal? or two year renewal? or at the end of five years if i become a permanent resident?

Hi Zev. You must have private or Expat health insurance for the first year. After that you can opt to pay into the national healthcare to opt-into the system – called the convenio especial.

Hi Alastair, Given my question relates to taxation I am not sure if you will be able to assist, but thought it worth enquiring.

I am an Australian resident, retired, and in receipt of the state pension, circa 840 €, per fortnight, plus a small private income, from dividends,, derived from shares, current value circa 150 K €. In addition I have sufficient funds to purchase a small property, which I could reside in.

1) I would appreciate your thoughts regarding the chances of my being granted a non lucrative visa, if I should apply for one, based on the above calculations. If necessary I could increase my small private income by rearranging my portfolio, but would prefer not to do so.

2) What I am unsure about though is where or not there would be any taxation implications with respect to my state pension, which is tax free.

3) Spain has a double taxation agreement with Australia BUT, I understand ( and I may be wrong ) that the threshold for paying income tax, in Spain, is lower that that in Australia. If this is so am I correct in assuming that despite a double taxation agreement being in place I would be liable for paying taxation, in Spain, on any income, derived from Australia which falls below the Australian income tax threshold, and that the double taxation agreement would only apply to income received, above the current Australian threshold.

Thank you,

Adam

Hi Adam. Based on the information you should qualify for the non-lucrative visa. Our legal partner would be able to advise how best to present the package in the application to maximise your chance of success. (I edited your comment with the correction you sent through – I hope that is OK!)

On the tax, I can’t give you specific advice. However, in general, here are a couple of key points. Your pension may be liable to tax in Spain, but not double taxation as per the tax treaty. And, Australia’s tax-free threshold is higher than Spain’s. This article has some good information on Spain’s taxation rates.

Keep an eye out – we’re hoping to be able to help with financial planning and taxation advice soon!

Hi Alistair,

Thank you for your reply, much appreciated.

Due to the current, virtual blanket prohibition on travel from Australia, it is probably best I wait until the travel prohibition is lifted before proceeding further. There is little point in submitting an application, the validity of which could expire before I am able to arrive in Spain, given the Australian government appears to be in no hurry to rescind the travel prohibition.

I will contact your legal department as soon as I have confirmation regarding the travel prohibition being rescinded and am able to proceed with booking a flight. Meanwhile I guess I will simply have to wait, and hope, that the current Spanish legislation regarding non.lucrative visas is not amended.

Regards

Adam

Good luck with the move – we’re looking forward to seeing our Australian friends again soon!

Hello, I am living in Australia I currently have $8000 AUD in savings. I’m not working at the moment, my only income is from the government welfare system. Which would terminate if I leave the country. Last year I was granted a travel exemption for travelling overseas for at least 3 months. My boyfriend is living in Spain and I wish to stay with him. What is the maximum amount of time I can stay on a non lucrative visa. I will have no expenses- accomodation, food, etc. will be provided.

Last year I was attempting to get a Schengen visa but had a lot of difficulties.

Appreciate your advice.

Hi Anna. The non-lucrative visa is issued for one year and is renewable after that. Your application doesn’t look at your possible expenses, just income and savings. Everyone has to meet the same level, and if you lose your income, you will have difficulty meeting that level. There may be other options for you – have a look at this article which has all of Spain’s visa and residency permit options.

Hi Alastair,

Hope you are doing well!

I live in Surinam and I have a Dutch partner who lives in Holland. We want to live in Spain. I have a saving of €35.000,- but no income at the time.

Can I apply for the non lucrative visa?

How do we find a place to stay in Spain?

Can I travel free to Holland in the first 183 days of the first year in Spain?

Thnx in advance!

Hi Jennifer. Without an income or large savings, the non-lucrative visa is difficult. However, as your partner is an EU citizen you may qualify for a family reunion visa, depending on the status of your relationship. A student visa may be another option for you to explore while you get settled here. A chat with a Spain immigration lawyer will help to find your best option.

To find a place to stay, check out our Guide to Renting a Property in Spain.

ON travel to Holland – yes, on a non-lucrative visa you can freely come and go as you please within the SCHENGEN region. However, your residence should be in Spain to qualify to renew.

Hi, if i move to Spain on a non lucrative visa and want to purchase a property to live in while I be stung for the Tax? Currently live in UK, or am I better to rent?

Many Thanks

Julia

Hi Julia. This is a difficult question to answer without understanding all your details. Where you want to live and the cost of the home all will impact tax rates, as will your immigration status. At present, we are not able to help with personal taxation advice, so you’ll need to chat with a specialist. But, watch this space – we will be offering Spanish Expat tax consultancy services soon!

Hi,

I am interested in a non lucrative visa. I have no income at present but savings of £150000. Would this be enough to apply? Also, how many months of bank statements would I need to show?

Thanks

Hi Paul. In general, some passive income is what the immigration department is looking for. I’d suggest having a chat with our Spanish immigration partner to see if there is a way to frame the application to get the right outcome.

Hello.

I am Ukrainian, currently live in Luxembourg. But I quit my job here and accepted an offer from Ukrainian company. Now I work remotely, but I’d prefer to live in Spain. Can i apply for non-lucrative visa while living in Luxembourg? Or i have to apply in Ukraine and stay there until its accepted?

And what are my chances? 🙂

Hi Iryna. You can apply from your country of legal residence, so if you are legally resident in Luxembourg you may be able to apply from there. Our Spain Immigration Lawyer will be able to quickly assess your chances and give you advice on how to have the best chance of success.

Hello and thank your for such an excellent detailed website.

Regarding the non-lucrative visa, if I have no remote income but have the equivalent of E230,000 in the bank would that enable me to qualify for this type of visa , then looking to change to a work visa after 12 months. ?

thank you

Hi Ross. Most consulates want to see some form of income. However, your savings are well in excess of the required amount to cover a year in Spain. I’d suggest chatting to our partner to see if there is a way to frame your application for success.

Hello – this site has been very informative !.

We are looking to buy a property Spain and move there permanently on a NLV, Would we be able to let a room out in our own residency to supplement my modest private pension?.

Regards

Chris

Hi Chris. Glad you found the site useful. Yes, you can purchase a property and rent out all or part of it on a non-lucrative visa. And, with a signed rental agreement you can even include the rent in your application or renewal. ONce thing to consider – if the purchase is more than é500,000 then a Spain Golden Visa may be a better option for you.

Where can you find detailed tax information. Specifically what are the agreements, if any, on double taxation.

Hi Roger. This UK government website is a good place to start. https://www.gov.uk/government/publications/spain-tax-treaties All the best, Alastair

Hi,

Could you please provide some clarification on getting a work permit after holding the non-lucrative visa for one year? Does having the non lucrative visa make it any easier to get a work permit like providing exemption from labour market tests ? Will I require sponsorship to work in Spain after one year ?

Regards,

Sankar

HI Sankar. Under the non-lucrative visa, you cannot change to a work permit in the first twelve months. After that, you can transfer to any of Spain’s ten work permits. You will need to fulfil the requirements of the work permit you select, and your residence permit will not give you exemptions from the requirements.

Hi Alistair,

I am Australian, 35 and have savings of 80 000euros i can show in my bank statement. As for income I have a side business which I get paid cash in hand so I’m unable to show tax documents for that. Will showing my bank statement be sufficient? I also own my own house and am planning to rent it out should I get the visa. Am I a candidate for the non lucrative visa?

Thanks xx

Hi Janetta. Your qualification is not cut and dried as you don’t have a tax return to support your side business income and the rental from your property is only in the future. There may be a way to effectively from the application, but you’d need to discuss your exact situation with a good Spanish immigration lawyer. All the best, Alastair

But don’t I have sufficient savings in my bank statement to meet the requirement? Also, what if I am able to produce a rental contract with my tenant? Do i need to show the tax returns still?

Hi. A rental contract and savings together will definitely help to support your application, and there may be no need to show your side income tax returns. All the best, Alastair

Hi .My husband and I are thinking of moving to Spain.We have no income but £470.000 in the bank.we would like to purchase a property and stay in Spain.Would we qualify for a lucrative visa please?

Hi Tracie. The Spanish immigration department generally likes to see some form of income. However, you do have considerable savings. Our Spain immigration partner would be best placed to discuss the best approach for you and your husband. If you purchase a house worth é500,000 then a Spain Investment visa might be worth exploring. IT has some advantages over the non-lucrative if you intending to buy the property anyway. All the best, Alastair

Alastair,

My husband and are are exploring moving to Spain. He is retired US Navy with a pension and I can work remotely. We meet the financial requirements for the non lucrative visa. My question is- my husband has a misdemeanor he pled guilty to for a crime in the US that does not appear to be a crime in Spain. The case is closed and the crime took place in 2018. We are looking at moving in 2-3 years. Do you think his criminal record will prevent us from getting the visa?

Hi Lisa. In general, the EU is less strict on past criminal history than, for example, the USA. The final decision will be based on the seriousness of the crime, the sentencing outcome, and the time since the conviction. If it is a minor misdemeanor, and the conviction is more than three years old by the time of application you should be fine. A quick chat with our immigration partner with the details of the conviction will allow you to get a more definitive answer. All the best, Alastair

I fulfil all requirements of this visa. How much your immigration partner charges for this visa after the first consultation.

Just a rough idea, so I can decide.

Hi Gani – I have sent an email to get some additional details. Regards,Alastair

Hi Alistair,

Thanks for your helpful responses. I’ve got a couple of questions on my situation.

I’m an Aussie looking to make the move to Spain. I believe I meet the requirements for the NLV but am looking a few different options:

1) move with my current company as they have a office/subsidiary in Spain – what would be the right visa for this?

2) find job with a company that has an office/subsidiary in Spain – what would be the right visa for this?

3) find a job with a company that doesn’t have an office /subsidiary in Spain and is say UK based but I would work remotely – what would be the best visa for this? The NLV? I know you mentioned this is a grey area but if there’s any tips or thoughts on this would be great to hear!

Thanks!

Hi Sarah. We have a full article on Spain’s 10 work visa options (click the link). The correct visa will depend on where your contract is held, and where you are paid. If you are working for a Spanish company then an Employee work permit will probably be your best option. If you are working remotely and can qualify for the non-lucrative without the remote work income then it is a good option – it also allows you to transfer to a work visa after one year if your situation changes. Once you are clearer on your employment plans our partner will be able to give you advice on the best option for both the short-term and long-term. Cheers, Alastair

Hello Alastair!

My fiance and are from the U.S., he is currently speaking to businesses in Spain and plans to get a job there.

We are in the process of researching the visas and moving to Spain early next year. We have a separate source of income through owned property, and I currently work from home with my own online business,

I have sufficient healthcare insurance, in good health. and don’t have a police record for any serious crime. I’m just wondering with my online business, would I be eligible for the non-lucrative visa?

Hi Lina. If you meet the income requirements for the non-lucrative from your property investment then yes, you’ll be eligible. If you need to add income from your online business then that complicates things slightly but can still be possible if your application is managed in the right way. There is no restriction on you continuing to work with your online business on the non-lucrative once you are in SPain. OUr partner will be happy to advise on the best approach for you – you can book a consultation here. Cheers, Alastair.

Hi there,

My partner and I (currently unmarried due to local laws disallowing same-sex marriage) are living outside of our home countries and are looking to move to Spain and work towards establishing permanent residency. She would ideally like to be a student pursuing a graduate level degree or program and I would like to live and work. That said, I’m happy to work remotely on this NLV.

1. Is it possible for me to be included as a dependent on her NLV or do we each need our own?

2. And is it possible for her to study on an NLV?

3. Does this visa count towards permanent residence? We want to live the rest of our lives in Spain.

4. Are we able to apply at the consulate in our current country of residence or do we need to go back to our respective countries where we retain citizenship?

Any advice you can give would be great!

Cara

Hi Cara. You and your partner will have a number of options include the NLV, a Spain work visa, and a Spain student visa. All have provisions for family members and dependants to be included. Your relationship status will need to be established as you are not married.

1) Yes, as long as the financial requirements are met you can include family members on the application.

2) Yes, both the primary applicant and dependants can study on the NLV (although a student visa may also be an option)