This article is from our sister site Moving to Spain and is reproduced here with permission.

Most Expats (and 25% of all Spanish people) have private health insurance in Spain. Although we qualify for the public health system in Spain, we still pay and use our private insurance provider for most of our healthcare needs. Given that Spain has free public healthcare, why do so many people like us opt for Spanish private medical coverage? We’ll explore the pros and cons of the private healthcare system for Expats covering visa requirements, immigration, and beyond. Finally, see our recommended private healthcare companies to help you choose the perfect cover.

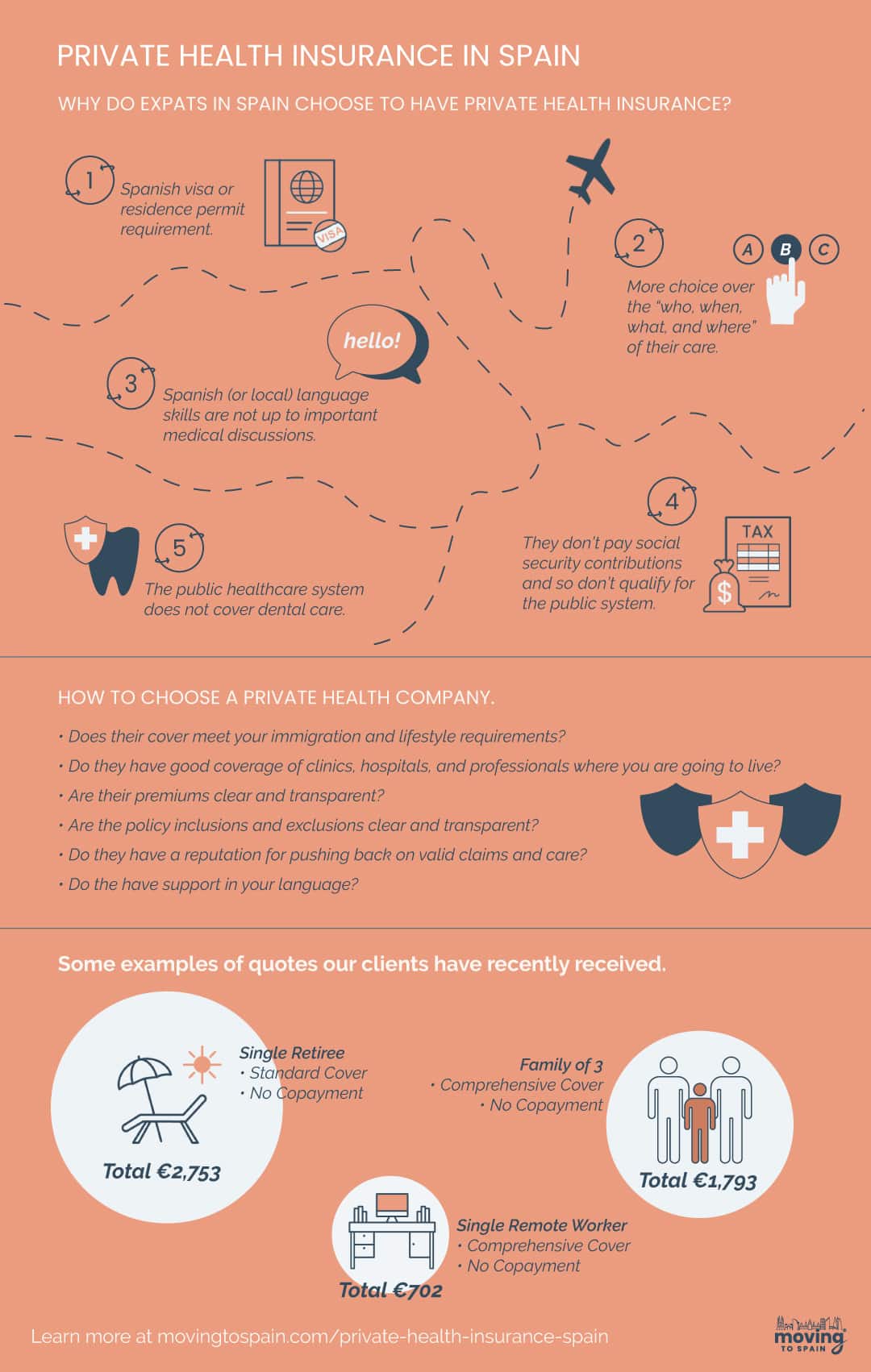

Why Choose Private Health Insurance in Spain?

Based on my experience living in Spain since 2015, there are 7 benefits of Private Healthcare in Spain for Expats.

- Your Spanish visa or residence permit requires qualifying private health coverage.

- You don’t pay social security contributions, so you don’t qualify for the public system.

- You want more choice over the “who, what, and where” of your care. You can select professionals based on your preferences, such as expertise in a particular medical field, location, or language proficiency.

- Private healthcare typically offers quicker access to specialists and faster scheduling of surgeries or treatments compared to the public system. And you have more flexibility in scheduling appointments and treatments.

- Many private healthcare providers in Spain have English-speaking doctors, staff, websites, and resources. If your Spanish (or local) language skills are not up to important medical discussions, it can make medical consultations and treatments stressful and put your health at risk.

- The public healthcare system does not cover dental care, risking significant out-of-pocket expenses for quality dental care.

- Ultimately, private healthcare offers you peace of mind, knowing you have prompt access to quality medical care in a language you understand, which can be incredibly reassuring when moving to Spain.

We’re delighted to use the fantastic Spanish public system for emergency care, standard medical issues, and prescriptions. However, for more severe or complex problems, we like to use doctors we know who speak excellent English in top-class facilities. Our Spanish is good enough to discuss car repairs with a mechanic, but nuanced discussions around our family health are best done in English! And our fabulous dentist (who our son trusts and is happy to see) is included in our policy.

Cost of Private Health Insurance in Spain

Private healthcare insurance will cost you much less in Spain than in the USA or countries like Australia. Here are three examples of actual client quotes in 2023 from our partners. And yes, they are annual policy amounts!

| Profile | Coverage Type | Annual Premium Cost |

|---|---|---|

| Family of 3 (Ages 47, 42, 9) | Comprehensive Cover, No Copayment | €1,793 |

| Single Retiree (Age 74) | Standard Cover, No Copayment | €2,753 |

| Single Remote Worker (Age 27) | Comprehensive Cover, No Copayment | €702 |

What 6 Factors Impact The Cost of Your Health Insurance Policy?

The amount you pay for your Spain health insurance policy will depend on five primary factors.

- Age and Health Status: Generally, the older you are, the higher the insurance premiums, as older individuals are statistically more likely to require medical services. This can mean higher prices for those retiring in Spain. Indeed, seniors may have difficulty finding cover, needing a Spanish company with specific policies for over 75s.

- Your current health status, including pre-existing conditions, can affect the average cost of private health insurance in Spain.

- Scope of Coverage: The extent of coverage significantly influences the cost. Comprehensive plans that include a wide range of medical services, such as specialist consultations, hospital stays, complex procedures, and dental care, will typically be more expensive than basic plans covering only essential healthcare services.

- Deductibles and Co-Pays: The structure of deductibles (the amount you pay out of pocket before insurance kicks in) and co-pays (the fixed amount you pay for a covered service) can impact the policy’s overall cost. Higher deductibles usually lead to lower monthly premiums but more out-of-pocket expenses when accessing care.

- Family Members Included: Including additional family members in your policy, like a spouse or children, will increase the overall cost.

- Discounts Through Referrals: Our insurance partners offer discounts or special offers to Moving To Spain clients. By using our quote tool, you can unlock these discounts, reducing the overall cost of your health insurance.

Remember: The cheapest health insurance for Spanish Residency might not be the best value for your family’s long-term health needs.

Health Insurance is needed for most visas & permits in Spain

Use our handy tool to get quotes from Spain’s top health insurance companies. As a Where Can I Live customer, you’ll get discounted rates and other benefits.

What Do Private Insurance Companies Cover?

So, what does a regular Spanish health insurance policy cover? We got a coverage list from the Standard Policy of one of our partners. The medical procedures and services this policy will cover are:

- Immediate access to private GPs, specialists, and emergency hospitals.

- Direct access to medical specialists with no waiting lists.

- Specialist treatments include oncology with chemo and radiotherapy, laser therapy, oxygen therapy, blood transfusions, physiotherapy, etc.

- If required, a private room for surgical and medical in-patient hospital visits (and a bed for a family member).

- ICU medical treatment.

- Psychiatric care.

- 24-hour emergency assistance

- Free choice of doctors and private clinics in our network.

- High-tech diagnosis methods include CAT scan, Nuclear Magnetic Resonance, vascular hemodynamic, and digital arteriography.

- All authorized medical tests are prescribed by one of our authorized professionals.

- Preventative medical strategies like annual checkups and second opinions.

- Medical travel insurance, including repatriation (up to 90 days a year).

- Family planning and childbirth.

- Dental cover including extractions and annual teeth cleaning

You do need to check your insurance plan for inclusions and exclusions. Our recommended Spanish private insurance companies offer clear and straightforward policy documents.

Best Private Health Insurance Options for Expats

When we first arrived in Spain, we used a large national insurer for our residency application. Our experience was so frustrating. Our Spanish was rudimentary, and their support and most of their medical staff only spoke Spanish or Catalan. While the GP we used was fantastic, one of the specialists and the dentist we used was sub-standard, to say the least.

Lesson learned! We did a ton of research and swapped to a new provider after a year in Spain, and we are still with them today.

So, we’ve polled Expats, trawled forums, and asked our clients for recommendations. From that, we’ve picked excellent private healthcare providers we trust to meet all 10 factors for our clients.

https://wherecani.live/tools-resources/expat-health-insurance/With this easy form, you can get quick, no-obligation quotes for the best private health insurance in Spain.

10 Key Factors to Consider When Choosing Health Insurance

- Visa Suitability: If you need cover for your visa or immigration application, make sure the cover is valid. The Spanish Immigration service has unambiguous guidelines for companies and covers they will accept.

- Coverage Scope: Evaluate what types of medical services are covered, such as hospitalization, outpatient services, emergency care, specialist consultations, and specific treatments or procedures. Check the coverage for pre-existing conditions.

- Dental Care: Determine if dental care is included or available as an add-on. Dental coverage can vary significantly, so if dental health is a priority for you, look for plans that offer comprehensive dental services or the option to add dental coverage.

- Network of Providers: Investigate the network of hospitals, clinics, and doctors associated with the insurance plan. Ensure there are quality healthcare providers near you, and check if your preferred doctors are in-network.

- Language and Communication: For some Expats, it’s crucial to have access to English-speaking doctors, medical staff, websites, and apps. Verify if the insurance provider offers services in English or your native language.

- Cost and Premiums: Assess the price, including premiums, deductibles, co-pays, and other out-of-pocket expenses. Balance these costs against the level of coverage and your budget.

- Policy Limits and Exclusions: Understand the policy’s limits, such as annual or lifetime caps, and be aware of exclusions, such as certain medical conditions or treatments.

- Customer Service and Support: Quality customer service is vital, especially in healthcare. Consider the insurer’s reputation for customer support, ease of filing claims, and assistance during medical emergencies.

- Additional Benefits and Features: Look for extra benefits or features that matter to you, like coverage for optical care, mental health services, alternative therapies, regular health checkups, or international travel coverage.

- Ethics and Company Reputation: Research the insurer’s track record for ethical practices, particularly regarding policy cancellations and handling claims. Choose a company known for fair and transparent dealings that doesn’t unjustly fight or deny legitimate claims. Get first-hand recommendations and reviews if you can.

Navigating Health Insurance for Visa Requirements

Most visas and residence permit applications require qualifying private health coverage. Raquel Moreno, our Spanish Immigration Lawyer partner, advises choosing your policy carefully. She explains that consulates will only accept health insurance plans that are:

- Fully comprehensive with no co-payment.

- No waiting period, so the policy offers full cover from the date of your arrival in Spain.

- From an authorized insurance company in Spain.

- There are no excluded pre-existing conditions.

Americans moving to Spain require the same cover as any non-EU citizen.

Note: The consulate will not accept Travel insurance for any long-stay visa. It is only acceptable for a short-stay SCHENGEN tourist visa.

Which Spain Visas Require Private Health Cover?

Raquel confirms you’ll need private health coverage for all long-stay residence visas and residence permits. The visas include:

- Non-Lucrative Visa

- Digital Nomad Visa

- Golden Visa

- Student Visa

- Employee and Self-Employed Work Visas

You can use our easy tool to get multiple qualifying quotes from accredited private health insurance companies in Spain. Private health insurance in Spain offers exceptional value and care if you have the right cover.

Health Insurance in Spain for Over 75-year-olds

Getting private health insurance can be challenging if you are over 75 years old. Many companies reject all applications from older Expats in Spain but don’t despair. Our partner specializes in coverage for older applicants and accepts applicants up to 99 years old. We’ve sent them happy clients who have received qualifying cover for moving to Spain.

You should ensure you’ll get the care you need, so the policy provides broad and relevant coverage for senior health requirements.

Get a quote for Spain Private Health Insurance for Over 75s.

Remember: Insurance premiums increase with age, and policies may be more expensive than for younger people. This scaling is not unique to Spain; insurance companies worldwide work this way.

International Student Health Insurance Spain

We think there are three things that international students studying in Spain should look for in their private healthcare policy.

- Visa Requirements: Ensure your health insurance meets the visa requirements – see our guide to the Spain Student Visa for more details. This is non-negotiable, as having the right insurance is vital to your visa application. Look for policies that cover the entire duration of your studies and provide comprehensive medical coverage.

- Comprehensive Coverage for Peace of Mind: Choose a policy that covers a wide range of medical services, including doctor visits, hospitalization, emergency services, and mental health support. Having a policy that covers your health needs means less worry, allowing you to dive into your studies and enjoy the Spanish lifestyle. It will also give your family back home some peace of mind!

- Affordability and Value: As a student, managing your budget is crucial. Find insurance that offers the essential coverage you need at a price that doesn’t strain your finances. Look for plans with clear terms about deductibles and co-pays to avoid unexpected expenses.

- Support in Your Language: Navigating healthcare in Spanish when you first arrive can be a significant challenge.

Why A Pre-Existing Condition Doesn’t Disqualify You From Cover

A pre-existing condition is “any health condition that a person has prior to enrolling in health coverage” – KFF.

You’ll be asked about pre-existing conditions when you apply for private healthcare in Spain. Many insurers reject your application or exclude cover for the condition, which makes it invalid for immigration. However, if you don’t disclose the issue and your insurer finds out, you could have a big problem. They can cancel your policy or refuse to pay for treatments.

We do have a partner that will cover applicants with pre-existing conditions. I asked them to clarify how it works.

“Our health insurance policies do not exclude pre-existing conditions; the pre-existing conditions are included and covered with suitable policies. The insurance premium that people pay depends on their medical review. Therefore most people pay an increased price for their pre-existing conditions.”

So, you will be covered, but you’ll have to pay for the increased risk the insurer has because of your pre-existing condition.

Get a pre-existing condition Spain Healthcare quote today.

Private Dental Insurance in Spain

Dental care is not covered by the public healthcare system in Spain. So, all dentistry and orthodontic care is user pays. Some people pay for this out of pocket, but many use private dental insurance coverage. All of our recommended insurers offer dental care as part of a package, add-on, or standalone policy.

We strongly recommend buying this cover. Dentists can be expensive in Spain (and orthodontists always are!). Finding a great dentist covered by your insurance makes a massive difference. Our experiences have been mixed. Our first healthcare company recommended a dentist in our town. They didn’t speak English and suggested a bunch of work that seemed crazy. I got a second opinion from a dentist who doesn’t accept insurance (so we paid out of pocket), and he confirmed that much of the work was unnecessary. So, we paid for dental care until we switched insurers. We now have a brilliant dentist with annual checkups and all work covered by our policy.

How Does Private Health Insurance in Spain Compare to Public Healthcare?

Spain offers excellent healthcare, both public and private. Both systems have pros and cons, so we’ve compared the most important factors.

| Feature | Public Healthcare | Private Healthcare |

|---|---|---|

| Access and Waiting Times | Longer waiting times for certain treatments and procedures Average specialist wait times: 67 days | Quicker access to specialists and elective procedures Average specialist wait times: 7 days |

| Choice of Providers | Assigned doctors and hospitals within your local area. | Freedom to choose doctors, specialists, and hospitals, including private facilities. |

| Language Services | Possible language barriers for non-Spanish speakers. | Often includes English-speaking doctors and staff. |

| Coverage Scope | Comprehensive for most health needs; may lack certain services like dental care. | Broader options for services, including dental and optical care. |

| Costs | Funded through taxes, free at the point of use except for prescriptions. | Involves premiums; costs vary based on coverage and individual factors. |

| Convenience | Standardized services with a focus on wide accessibility. | More flexible appointment scheduling and modern facilities. |

Another Option

International Health Insurance (also called Expat Health Insurance) is a different product. And, if Spain is not your last or only Expat home, consider this option.

International Health Insurance policies are not country-specific. So, If you live in Spain and then move to Dubai, your cover moves with you. You don’t need to find a new insurer and reapply each time you emigrate.

These products are generally more expensive than local Spanish policies but offer excellent value for many serial Expats.

Check out more information on International Insurance here.

Ready to Choose?

Based on my years of experience, the right insurer offers peace of mind. Our initial insurer is a significant player that many lawyers recommend. Our experience was terrible – language was a constant issue, and some healthcare professionals were substandard. We struggled to even book appointments in some cases.

We moved to our current insurer and have been very happy since then. Our advice: – get independent recommendations, check Expat forums for first-hand reports, and get multiple quotes. Private health insurance in Spain offers exceptional value and care if you have the right coverage!

FAQ – Private Health Insurance Spain

What Are the Key Benefits of Private Health Insurance in Spain for Expats?

The key benefits of Private Health Insurance in Spain are improved choice of where, when, and how you are treated. You have access to more facilities, your access to English-speaking healthcare professionals is more accessible, and wait times are shorter.

How Does Private Health Insurance in Spain Compare to Public Healthcare?

The Spanish public healthcare system is one of the best in the world. Our experiences have always been excellent, from emergency room care to vaccinations. However, private health insurance in Spain typically offers faster access to medical services, reduced waiting times compared to public healthcare, and flexibility in choosing doctors and hospitals. Private insurance has more English-speaking medical staff and covers services not fully included in the public system, such as dental care. While public healthcare is funded through taxes and social security and is generally free at the point of use, private insurance involves paying premiums.

What Should Expats Look for When Choosing Private Health Insurance in Spain?

Expats should look for private health insurance that offers comprehensive coverage, including for pre-existing conditions and a range of medical services. Choosing a plan with a broad network of hospitals and clinics is essential, preferably with English-speaking healthcare providers. The cost, including premiums and out-of-pocket expenses, should fit within their budget. Additionally, you should evaluate the insurer’s customer service reputation, policy limits, and any additional benefits like dental or international coverage.

Which Spain Visas Require Private Health Cover (and the conditions to qualify)?

All long-term visas in Spain require qualifying private health insurance until you have public healthcare in Spain. This includes the Non-lucrative visa, Digital Nomad Visa, Golden Visa, and Student Visa.

The cover must be fully comprehensive and have no exclusions for pre-existing conditions – use this tool to get qualifying Spain private healthcare quotes.

Does Private Health Insurance in Spain cover Pre-Existing Conditions?

Coverage for pre-existing conditions varies among private health insurance providers in Spain. Some insurers cover pre-existing conditions with specific limitations or higher premiums, while others might exclude them. It’s crucial to carefully review the policy details or consult with insurance providers to understand the coverage for pre-existing conditions.

How Do Age and Health Status Affect Private Health Insurance Costs in Spain?

Age and health status significantly affect the cost of private health insurance in Spain. Generally, older individuals and those with pre-existing health conditions or higher health risks may face higher insurance premiums. When selecting a suitable private health insurance policy, you should compare different plans and consider these factors.

How much do you pay for health insurance in Spain?

Standard cover with a large co-payment for a young person can be as little as €300 annually. Comprehensive cover with no co-payment for a 70-year-old could be around €2,500 annually.

Do you have to pay for health insurance in Spain?

No, Spain has free universal healthcare for many Expat residents and all Spanish nationals. However, if you do not qualify for free care, you must pay for private medical insurance to live in Spain.

Can US citizens get healthcare in Spain?

Yes, Americans moving to Spain can buy private health insurance in Spain and sometimes qualify for free public healthcare.

Can US and UK citizens get free healthcare in Spain?

Only Americans and British citizens who pay social security contributions can qualify for free healthcare in Spain. Most Expats must pay for Private Healthcare as part of their visa requirements.

Do you need insurance to go to a hospital in Spain?

No, not in an emergency. Everyone is entitled to free emergency medical attention in Spain. Many private hospitals in Spain also accept direct payment for treatments.

Good day,

Are you saying you have a private health insurance next to the national health servide? How would that work?

Hi Rudy. The two health services operate in parallel. If you have access to both systems you can choose with to access. All the best, Alastair

Could having a pre-existing condition result in being denied private insurance, and therefore be denied the non-lucrative visa? Is there an insurance company that will provide the required coverage for the residence visa regardless?

Hi Ana – you’ll need to speak with some private health insurace companies in Spain to figure out if your pre-existing condition can be accepted into a qualifying policy. We suggest you start with the companies we recommend on this page. All the best, Alastair

As a US citizen, applying for a non lucrative visa, can I use my private Spanish insurance in public clinics such as those that are generally for the free health care for Spanish citizens?

I ask, because there is a clinic I can walk to, instead of driving 40 minutes to a private facility.

Thank you!

Hi Betz. In general, the public and private health care systems in Spain do not cross over. But, it is worth checking with your private health cover provider to see which clinics they cover. All the best, Alastair

My brother lives in Arens de Lledó, Spain with his wife and son. Our mother in United States. Is it unrealistic to think she could move and live with him and his family in Spain. She is 83 and has preexisting health issues (diabetes). She collects social security and has some savings and assets she could bring with her. Is private insurance for her a long shot/even possible?

Hi Drew. Finding qualifying private health insurance will be very difficult given your mother’s age of 83. I’ve checked with the two insurers we recommend, and neither would be able to offer qualifying insurance for either a family reunion or a non-lucrative visa. Sorry, I don’t have better news. ALastair

Hi both my wife and I have not reached the retirement age but decide to live in Spain. My wife has MS and we are looking for a private health to cover her!

Hi Philip,

Unfortunately, most Private Healthcare companies do not cover pre-existing conditions. However, there is no harm in asking. You can fill out one form and get three quotes from the top Healthcare companies in Spain on our website here ->> https://wherecani.live/services-tools/spain-health-insurance-quote/.

Alison

Hello Retired Veteran, I get coverage under Veterans Affairs and it does cover me and my daughter in foreign countries will this be okay for lucrative visa?

Hi Nataly. As long as you don’t work for the income and it is consistantly above the threshold it should qualify for the non-lucrative visa application. All the best, Alastair