This article is from our sister site Moving to Spain and is reproduced here with permission.

The Spain Digital Nomad Visa is an excellent option for living and working in Spain. This residence permit is great for digital nomads, remote workers, and freelancers. Importantly, employees of non-Spanish companies can use it as a Spain Remote Work Visa. We’ll look at who qualifies, how to apply, and the 2023 financial requirements for the Spanish Digital Nomad Visa. The offical Spanish name for this visa is the visado de teletrabajador de carácter internacional.

UPDATE: The financial qualifications are the updated 2024 amounts.

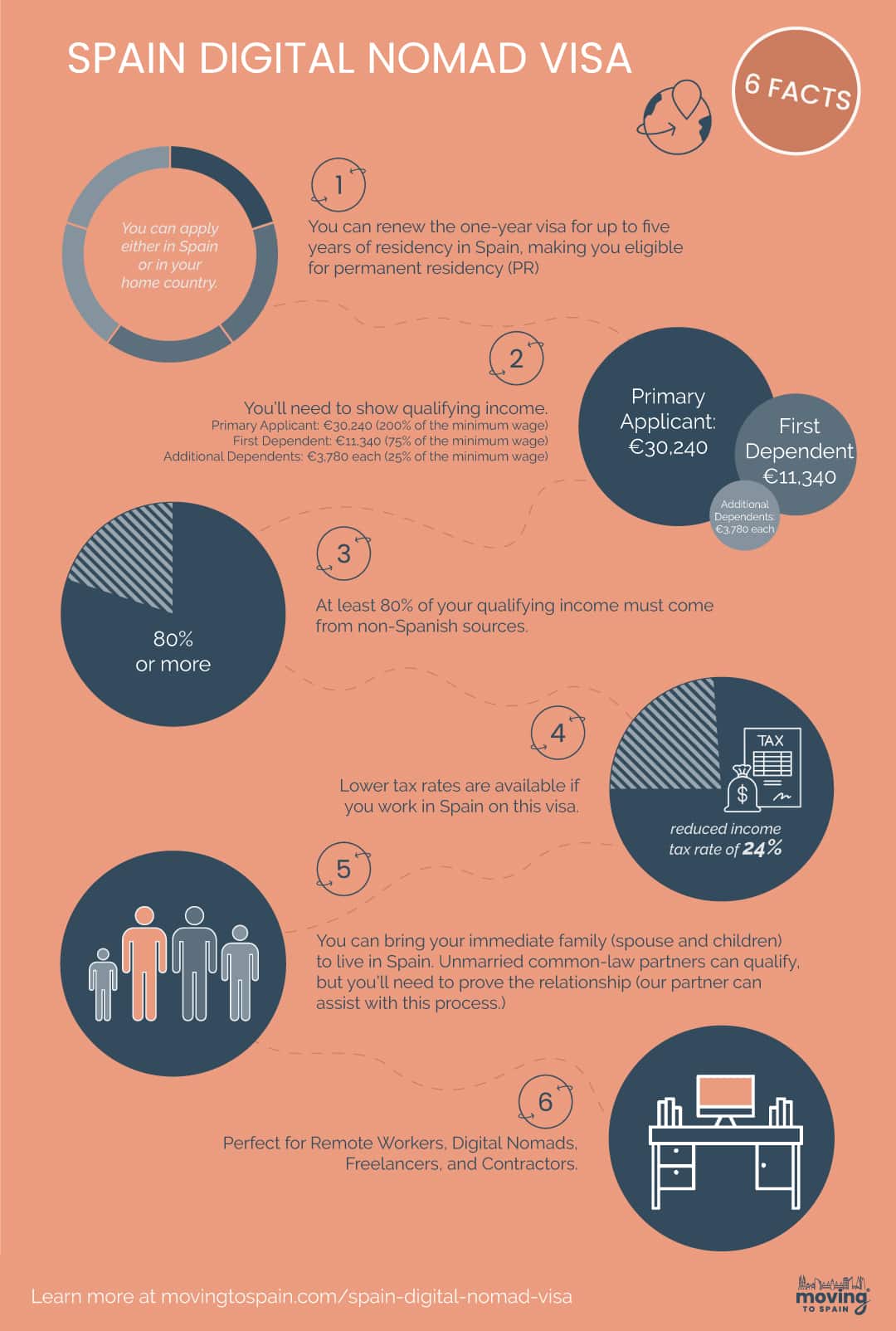

6 Facts about the Spain Digital Nomad Visa

- The initial visa is valid for one year, and you’re eligible for a two-year renewable residence permit.

- You’ll need to show qualifying income – we’ll cover this requirement in detail below.

- At least 80% of your qualifying income must come from non-Spanish sources.

- Lower tax rates are available if you work in Spain on this visa.

- You can bring your immediate family (spouse and children) to live in Spain. Unmarried common-law partners can qualify, but you’ll need to prove the relationship (our partner can assist with this process.)

- You can qualify for Spanish Permanent Residency (PR) after five years. After ten years, there is a pathway to Spanish citizenship and an EU passport.

Who can use the Spain Digital Nomad Visa?

The visa is open to non-EU/EEA citizens over the age of 18 years. It will suit:

- Digital Nomads (nómadas digitales).

- Location-independent business owners.

- Remote Workers employed by non-Spanish companies.

- Freelancers or self-employed (With 80% of revenue from outside Spain and established clients).

- Consultants (With 80% of revenue from outside of Spain and established clients).

US W2 Employees: There are issues with US nationals who are W2 employees as there is no reciprocal social security agreement, so if this is you, we suggest exploring other Spanish visa types.

Note: EU / EEA citizens can live and work in Spain without a visa.

Spain Remote Worker Visa Requirements

To use this as a Spanish Remote Work Visa, you’ll need to meet these standards:

- You have a permanent position employment contract with a non-Spanish company.

- The company has been trading for at least one year.

- The company has employed you for at least three months.

- Your employer has given you permission to work remotely (trabajo de manera remota) in Spain.

Check out our Remote Work in Spain Guide for more information.

Note: You need to be a contract worker for a US company, not a direct employee, to use a Digital Nomad Visa to work remotely for an American company in Spain.

READ ALSO: How to Work Remotely From Spain >> 2024 Visa, Tax & Healthcare Guide

2024 Qualifying Income for the Spanish Digital Nomad Visa

You’ll need to show you can meet at least twice the Spanish minimum wage. The minimum wage for 2024 is €15,876 annually. The government set the 2024 qualifying figure when it adjusted the minimum wage for 2024.

- Primary Applicant: €31,752 (200% of the minimum wage)

- First Dependent: €11,907 (75% of the minimum wage)

- Additional Dependents: €3,969 each (25% of the minimum wage)

Note: This income figure is your gross income, so total income before tax.

How to prove your financial qualification

There are three options to show you can support yourself.

- Proof of a salary or income.

- A bank certificate that shows savings.

- A mix of income and savings.

Note: Each consulate has slightly different requirements for presenting your Spain Digital Nomad visa application. You’ll need to have some documents translated by an authorized translator and some copies certified using the Apostille process. Your immigration lawyer will advise you on these requirements.

Application process

There are two ways to apply for this visa:

1) Enter Spain on a Spanish SCHENGEN tourist visa and apply in Spain. You’ll be able to get a three-year residence permit immediately.

2) Visit your nearest Spanish Embassy or Consulate and get a 1-year Digital Nomad visa. You can use the visa to enter Spain and then apply for your residence permit in Spain.

You’ll get an answer quickly – The Spanish government has just 20 days to assess your application. The Spanish government agency that deals with this visa class is the Spanish UGE unit (Unidad de Grandes Empresas y Colectivos Estratégicos).

Either way, you’ll need to visit your local police station when you move to Spain. They’ll take fingerprints and issue your residence card (T.I.E. or Tarjeta de Identidad de Extranjero).

Easy Hack: Our partners are experts in successful Spanish Digital Nomad Visa applications.

Need Help with your Spain Visa or Residency?

Raquel and her team have helped over 600 of our clients with their visas, and we get fantastic feedback on their service. They offer a 30-minute consultation to confirm the best visa route for you, walk you through each step of the process, and answer any questions.

Application requirements

- A completed application form.

- Provide evidence of qualifying employment or income.

- Show that you have:

- Qualifying private health insurance coverage.

- Proof of accommodation in Spain.

- No disqualifying criminal convictions

- Pay the application fee of around $75 per applicant.

Note: There are specific requirements for translation and certification of documentation. Check with your Spanish immigration lawyer to ensure this is done correctly.

At this appointment, the local police will take your fingerprints and issue your identity card (T.I.E.).

Qualifying Private Health Insurance

The Spanish Immigration Department has very specific requirements for your medical insurance in the application. Not all policies are accepted, and any exclusions or co-payments can disqualify you. You can use our easy tool to get three qualifying quotes for excellent Spanish Private Health Insurers.

Health Insurance is needed for most visas & permits in Spain

Use our handy tool to get quotes from Spain’s top health insurance companies. As a Where Can I Live customer, you’ll get discounted rates and other benefits.

Once you arrive in Spain

After you travel to Spain, you have 30 days to register your residency in Spain with the local municipality. This is the standard Spanish residency registration, and your immigration lawyer should be able to assist.

You’ll also need to transfer money to Spain easily and quickly.

Tax Benefits for Digital Nomads and Remote Workers in Spain

You won’t pay Spanish tax until you are a Spanish tax resident. However, the new law has a big tax break. You can opt to pay non-resident income tax rates (IRNR) instead of resident income tax rates (IRPF). That gives you a flat 24% tax rate (up to an income of €600,000) instead of the progressive rate that can reach 48%. These rates last for up to five years. These tax breaks add to Spain’s reputation as one of the best countries in Europe for remote workers.

Note: You must apply for IRNR rates – the Spanish tax authorities don’t automatically apply the preferential rates. You have one year from your registered arrival to apply.

And you’re exempted from Spain’s Wealth Tax.

This allowance is part of the Startup Law passed on December 23rd, 2022, which aims to boost entrepreneurship in Spain.

Support: There are awesome opportunities to save on Spanish tax – but they are complex. Making a mistake or missing a deadline can cost you a fortune. Book a consultation with our expert Spanish tax advisor partner to save time and money.

READ ALSO: Spanish Tax System Guide – Expat Essentials 2024

Spain Digital Nomad Visa vs. Spanish Non-Lucrative Visa

Historically, some digital nomads and remote workers have used Spain’s Non-Lucrative Visa (NLV). However, the NLV prohibits work, and some embassies (but not all) rejected applications from remote workers.

The key differences:

- The non-lucrative visa does not allow working in Spain.

- You cannot apply for a non-lucrative visa in Spain.

- There are no preferential tax rates or exemptions on the non-lucrative visa.

Remote workers or digital nomads living in Spain on a non-lucrative visa should explore an immigration status change to the digital nomad visa for Spain. You’ll be 100% on the right side of the law and may get a nice tax break in the bargain.

Next Steps

https://wherecani.live/reviewers/raquel-moreno/Does living in and working in Spain on a low tax rate appeal? If so, please book a consultation with our Spain Immigration Lawyer partner today. They’ll be happy to answer any questions about Spain’s Digital Nomad Visa.

FAQ – Spain Digital Nomad Visa

Does Spain offer a digital nomad visa?

Yes, Spain has a Digital Nomad Visa launched in December 2022. It is popular with digital nomads, freelancers, and remote workers.

Can I work in Spain on a digital nomad visa?

Yes, you can work as a remote worker for non-Spanish companies. And, as a digital nomad or freelancer with 80% of customers or clients outside of Spain. Note: There are issues with US nationals who are W2 employees as there is no reciprocal social security agreement, so if this is you, we suggest exploring other Spanish visa types.

How to get a Spanish digital nomad visa?

You can apply before you come to Spain or in Spain on another visa (including a tourist visa).

Do digital nomads pay tax in Spain?

Yes, if you are a resident of Spain for tax. Spain Digital Nomad visa holders qualify for lower tax rates than normal Spanish taxpayers.

Which European countries offer digital nomad visas?

Spain joins many European and EU Countries offering Digital Nomad Visas or Remote Work Visas. Others include Portugal, Croatia, the Czech Republic, Estonia, Germany, Hungary, Greece, Iceland, Italy, Malta, Romania, and Norway.

Can I move to Spain and work remotely?

Yes, Spain’s new Digital Nomad Visa is perfect for Remote Workers in Spain employed by non-Spanish companies.

How do I qualify for a digital nomad visa in Spain?

– Be a non-EU/EEA citizen over 18 years.

– Either work remotely for a non-Spanish company or be a freelancer with at least 80% of your revenue from outside Spain. Or, have a permanent employment contract with a non-Spanish company that has been trading for at least a year and has employed you for a minimum of three months.

– Show proof of a salary or income that meets at least twice the Spanish minimum wage (for 2024, this is €31,752 annually for the primary applicant).

Can I Get Help Applying for a Spain Digital Nomad Visa?

Yes, our partner is experienced in successful digital nomad visa applications. You can book a consultation with a Spanish Immigration Lawyer here.

Is the income requirement for Spain’s digital nomad visa a gross or net figure?

The income requirment for Spain’s Digitial Nomad Visa is your gross income (ingresos brutos).

Great article! We have visited San Sebastian 2-3 times a year since my wife did her first (320 km) walk on the Camino de Santiago de Compostela back in 2015. We usually stay 3-6 weeks each visit.

We have worked on Non-lucrative Visas and researched Golden Visas, but are not interested in obtaining either.

We have followed the Spanish Digital Nomad Visa and were in San Sebastian this past December, 2022 trying to get a Temporary Residency Card from the local Oficina de Extranjeros and Ayuntamiento in the city, but could not make an appointment.

We are senior citizens, residing in Georgia, USA, with gross indirect income greater than the Spanish requirements.

I would work as a freelancer in the travel industry. We also do not foresee being in Spain for more than 180 days per year as we have obligations in the USA.

We can discuss the best course of action to apply for and obtain a Digital Nomad Visa.

Thank you!

Robert & Carol Cain

Hi Robert and Carol. Please book an appointment with Raquel – our Spanish Immigration Lawyer partner. She’ll be happy to assist you with your Digital Nomad Visa application. Regards, Alastair https://wherecani.live/services-tools/immigration-lawyers-spain/

Hello Alastair,

Thank you for the information of the new Digital Nomad Visa for Spain.

I have a question:

– if you receive the visa and you are on the path for permanent residency, is there a requirement that you must be Spain for so many days per year. For example, could you go back and forth to Canada, or must you spend the majority of the time in Spain?

Thank you for your response,

Diana (Calgary, Canada)

Hi Diana – I checked this with Raquel, our Spansh Immigraitn law partner. The normal residency requirments for PR apply (regardless of the visa or permit):

– 5 years in Spain.

– Not more than 6 months a year out of Spain and not more than 10 months in the 5 years period (12 months if the trips are for job reasons).

Cheers, Alastair

Thank you so much for responding. It is much appreciated.

Take care,

Diana

Hi Alistair,

My wife and I were hoping to live in Spain for 6 months and the US for 6 months each year on either the digital nomad or non lucrative visa. I didn’t know about the 10 month limit for being out of Spain for 5 years to qualify for PR. So, 2 questions. Will my wife and I be allowed to renew our visas after 1 year, and 3 years. And then, what happens in 5 years? Can we continue to renew our visas for 2 years at a time? Thank you so much!

John and Mariana from Oregon

I’ve clarified this with Raquel, our Spanish Immigration Lawyer. You can renew your visa every two years (years 1, 3, 5, 7, etc.) as long as you meet the 183 days/year residency requirement. However, you will only qualify for PR with up to 10 months outside Spain over the 5-year qualification. Cheers, Alastair Raquel’s answer is below:

“To renew they must reside in Spain 6 months + 1 day a year. To get PR they should meet the 10months rule. If not, they can keep renewing the permit for periods of 2 years.”

Would I incur capital gains tax whilst on a digital nomad visa if I sold property and or other investments outside of Spain.

Hi Clinton. If you are classified as a fiscal non-resident under the Digital Nomad Start-Up tax classification, then no. You don’t pay capital gains (or wealth tax) on assets outside of Spain. Regards, Alastair

Hello i want to find the best way to get into Europe the legal way and cheapest way

Hi Amir – check out the Europe seciton of this article https://wherecani.live/easiest-countries-to-move-to/ Regards, ALastair

Hi Alistair, two quick questions: I understand I can’t stay in Spain more than 183 days without paying Spanish taxes but I see no information about a shorter stay with the digital nomads visa. With that visa, can I stay 150 days each year? Second question: Am I eligible for that visa if 80% of my work, including all work performed in Spain, is digital but I still have to do very limited hands-on work during the months I’m not in Spain?

Thanks for your help, Dana

Hi Dana. 1) You’ll need to spend 183 days in Spain to renew your residence permit. 2) As long as 80% of your income comes from non-Spanish sources you qualify. Regards, Alastair

Hi there,

This information is all so helpful! My 2 sons, our dog and I are planning to move to Spain this summer.

One tricky piece for us is that my two sons turn 18 in May. Can I still count them as dependents when I apply for my digital nomad visa or will they have to go through their own process to secure some kind of longer-term stay in Spain? Which also leads me to the question –How long can we stay in Spain on just a tourist visa while I work on the other pieces? And is it smart to secure a rental for the year before we move there? Will people even rent to us if I don’t yet have proof of some kind of longer-term stay visa? It’s hard to know which piece to do first. And I’m especially concerned about the age piece for my sons.

I was considering moving us there first and then securing an English teaching position locally (I am actually a teacher) which I know would disqualify me from the digital nomad visa… do you know what type of visa that would allow me to apply for? And again could my boys be counted as dependents if they turn 18 this May shortly before we make the move?

Sorry for so many questions!

Thank you in advance for your advice!

Tara

Hi Tara. As your situation is complex, I’d suggest meeting with our Spanish Immigration Lawyer, Raquel. She’ll help you with the best solution. I’d suggest meeting soon as it may benefit you to submit your application before your sons’ birthday. All the best, Alastair

Hello Alastair,

Thanks for your informative content.

I have more than 60.000 Euros as savings, and around 400-500 Euros of monthly income from freelancing and remote work. Can I use this combination to get the Digital Nomad Visa? Most importantly, is this program open for Iranian citizens (residing outside Iran), and have you seen any cases of Iranians being accepted or rejected after applying?

Hi Setareh – Iranian citizens are not restricted from applying for the new Digital Nomad visa. As you don’t meet the income requirement outright, I’d suggest speaking with our partner, Raquel. Her law firm will advise you on how to structure your application best. Regards, Alastair

I have a question. What happens if you come to Spain and get a DMV and subsequently lose your job?

Can I change the employer after I came to Spain with this visa?

Yes, as long as you continue to meet the requirements. All the best, Alastair

Hi Alastair

Great job with the website! Two quick questions for you: 1.) Switzerland is not EU nor EEA, yet there are some other sites that include its citizens as non-eligible for the digital nomad visa. Can you please confirm if Swiss can apply? 2.) I understand the Beckham law application within the digital nomad and the 183-day rule for Spanish taxes, but I have seen a figure of 15% associated with this visa. Do you have any insights here?

Thank you!

Hi Felix. Swiss citizens have the right to settle in Spain and so are not able to apply for a Digital Nomad Visa. Please see the link for a detailed article on the amended Beckham Law in Spain. Thanks, Alastair

Hello,

I am a freelancer in the US and have a family of 5 ( 2 adults & 3 children)

I am increasing my client base but currently we are netting approximately 3800 profits/mo

that said I have almost $60,000 in bank account.

Additionally we are selling our home and the estimated profit will leave and additional $240,000 in the bank totaling ~$300,000 in the bank.

I am not sure if we would even be considered as we do not “currently” meet the 200% smi requirement. I fully expect to meet and exceed this requirement by renewal time if we can get through.

Would it be worth it to try and apply or do we simply need to wait?

Any insight would be greatly appreciated.

Hi Daniel – I’d suggest meeting with our immigration lawyer partner as, given your overall financial situation, you should be able to out together a compelling application. All the best, Alastair